Unlock predictable revenue growth with this definitive B2B SaaS playbook. Learn to diagnose funnel leaks, align teams, and build a data-driven scaling engine.

Feeling the frustration of stalled revenue growth? You're not alone. When you’re staring at misaligned teams and data that just creates more questions than answers, the common advice to "optimize the funnel" feels vague and unhelpful. It leaves you without a clear path to predictable ARR.

This guide isn't about vague theories. It’s a concrete playbook designed to help you diagnose the real blockers in your revenue engine, align your teams around a single goal, and execute high-impact plays that deliver measurable results in weeks, not years. You'll get actionable frameworks and a step-by-step plan to transform your go-to-market motion from reactive fire-fighting to proactive, strategic scaling.

Moving Beyond Guesswork in Revenue Growth

If your growth has hit a plateau, it’s rarely because of one giant, obvious problem. It's almost always a series of small, interconnected friction points—things like slow lead handoffs between marketing and sales, messy CRM data, and a fundamental disconnect between what marketing is doing and what sales actually needs to close deals. This playbook is designed to cut through that noise.

A team of professionals collaborating on a chart showing upward revenue growth trends.

We’re moving past vanity metrics and into a concrete framework that diagnoses the real blockers in your revenue engine. This is all about building systems that tell you what’s actually working, not just what looks good on a dashboard.

The Perception vs. Reality Check

One of the biggest hurdles we see is the gap between what leadership thinks is happening and what the data shows. This disconnect is where revenue leaks hide in plain sight. Sales leaders might report 90% compliance on follow-up cadences, but CRM data often reveals the reality is closer to 30%. A quick diagnostic can reveal these uncomfortable but necessary truths.

Here’s a simple framework to run this initial reality check. It helps you quickly spot where perception and reality are out of sync, giving you a clear starting point for your investigation.

| Area of Focus | Common Leadership Perception | Data-Driven Reality | Initial Action Step |

|---|---|---|---|

| Lead Follow-Up | "Our sales team is diligent and follows up on every MQL within 24 hours." | CRM data shows the average follow-up time is 72 hours, and 30% of MQLs never receive a call. | Audit lead routing rules and implement a time-based SLA with automated alerts in the CRM. |

| Marketing Contribution | "Our content marketing drives significant pipeline." | According to Forrester, only 1% of leads ever convert to customers. Attribution reports show 80% of your pipeline comes from outbound and referrals; content is driving traffic but not converting. | Analyze which content assets are touched by closed-won deals and double down on bottom-of-funnel content. |

| Pipeline Health | "We have a healthy 3x pipeline coverage for the quarter." | A deeper look reveals 40% of the pipeline has been stalled in the same stage for over 60 days. | Implement a "pipeline hygiene" process to flag and address stalled deals weekly. |

| Customer Expansion | "Customer Success is focused on identifying upsell opportunities." | CS team incentives are tied to retention only, and there's no formal process to hand off expansion leads to sales. | Create a shared CS-Sales playbook for identifying and acting on expansion signals (e.g., high product usage). |

This table isn't just a theoretical exercise; it’s a critical first step. Uncovering these gaps is what separates companies that guess from companies that grow. It moves the conversation from opinions to objective facts, which is the only way to build a scalable revenue machine.

This guide provides actionable plays you can implement in weeks, not years, transforming that reactive fire-fighting into proactive, strategic scaling. You will learn to:

- •Diagnose Funnel Leaks: Pinpoint exactly where you're losing potential revenue with a structured audit.

- •Align Sales & Marketing: Move from departmental silos to a single team focused on shared revenue goals.

- •Implement Quick Wins: Execute high-impact tactics that build immediate momentum and confidence.

- •Build a Data Foundation: Establish a single source of truth that drives intelligent, scalable decisions.

"The best CS teams are using AI to surface expansion signals early. They’re finding new executive stakeholders, increasing product adoption, and spotting readiness for an upgrade—all in real time." - Marilee Bear, Chief Revenue Officer, Gainsight

By focusing on this kind of operational rigor, you can finally pull the specific levers that drive predictable growth. The principles we'll cover are fundamental, a topic we explore further in our guide to AI-powered Revenue Operations. It's time to stop guessing and start building a system for repeatable success.

How to Diagnose Leaks in Your Revenue Funnel

Before you can build a predictable revenue machine, you have to find out what’s quietly killing your growth. Most revenue funnels don’t have one giant hole; they have dozens of small, hidden leaks bleeding cash and opportunity. Fixing them requires a diagnostic framework that goes way beyond your surface-level dashboards.

A detailed analytics dashboard on a laptop screen, showing various sales and marketing metrics.

This is about asking the right questions to uncover the real bottlenecks. It’s not enough to track your overall MQL-to-SQL conversion rate. You need to dig into the operational metrics that drive that number.

Moving Beyond Vanity Metrics

The real story isn’t in your high-level conversion percentages. It's buried in the granular, day-to-day activities that produce those outcomes. Your goal is to stop treating symptoms and start diagnosing the root cause. This means shifting your focus from "what" happened to "why" it happened.

For instance, a low demo-to-opportunity conversion rate is a symptom. The cause might be a sloppy discovery process, misaligned lead qualification criteria, or even reps who are uncomfortable talking about pricing.

To get started, zero in on these critical areas:

- •Lead Response Time: How quickly does your team actually follow up with an inbound lead? A famous study originally published in the Harvard Business Review found that companies contacting leads within an hour were nearly seven times more likely to have meaningful conversations. Waiting just a bit longer can kill a deal before it even starts.

- •Follow-Up Cadence Adherence: Are your reps consistently following your prescribed sales cadence? You’d be shocked by the gap between leadership's perception ("we follow up 8 times") and reality ("most reps give up after 2 attempts"). The data in your CRM will tell the true story.

- •Conversion by Source and Rep: Which marketing channels produce leads that actually close? And which reps are most effective at turning demos into pipeline? These answers are gold.

“The most common mistake is focusing on top-of-funnel metrics like MQLs instead of revenue-centric metrics. Teams chase volume over quality, leading to misalignment and a leaky funnel.” - Jason Lemkin, Founder, SaaStr

Answering these questions reveals the truth hiding in your data. We worked with one SaaS company that discovered their 'demo no-show' rate was 40% higher for leads from a specific ad campaign. This insight was completely invisible on their main dashboard but became glaringly obvious once they segmented their data. That single discovery allowed them to reallocate budget and instantly improve their pipeline quality.

Asking the Right Diagnostic Questions

You need a structured approach to this. It's not about boiling the ocean; it's a focused investigation into the highest-impact areas of your revenue process. This is how you move from reactive firefighting to proactive optimization.

A sales analytics dashboard, like this example from HubSpot, gives you a starting point. It highlights key metrics like deal forecasts and pipeline activity.

Screenshot from https://www.hubspot.com/products/sales

But the real insights come from dissecting each number to understand the underlying drivers and pinpoint where the leaks are happening.

This level of detailed analysis is becoming non-negotiable. The revenue management market in the Middle East and Africa, for example, hit USD 410.97 million and is projected to grow at a CAGR of 13.9%, driven by the need for exactly this kind of insight.

Here are 12 critical questions your team must be able to answer with data, not anecdotes. We've compiled them into a checklist to guide your audit.

- •What is our average lead response time, segmented by source?

- •What percentage of MQLs receive a first touch within our SLA (e.g., under 1 hour)?

- •How many follow-up attempts does an average rep actually make before marking a lead as disqualified?

- •What is our meeting-held rate for demos that get booked?

- •Which marketing channels generate the highest demo-to-opportunity conversion rate?

- •What’s the average sales cycle length for deals we win versus deals we lose?

- •At which specific stage in our pipeline do most deals stall out?

- •What is the win rate for opportunities, broken down by each individual sales rep?

- •How does the average deal size vary by lead source?

- •What percentage of our closed-lost deals are due to "no decision" versus a competitor?

- •How accurate is our sales forecast at the beginning of the quarter versus the end?

- •What percentage of our customers add new services or upgrade within their first year?

This diagnostic audit is the foundation for any successful revenue growth strategy. It replaces assumptions with facts and gives you a clear, prioritized roadmap for what to fix first. To get a better handle on the financial impact of these leaks, you can use our free Revenue Leak Calculator to quantify the opportunity cost.

Aligning Sales and Marketing Around Revenue

Let's be honest. The biggest thing killing your predictable revenue growth isn't a bad product or a tough market. It’s the constant, grinding friction between your sales and marketing teams.

When these two teams operate in separate worlds, you get a system designed for failure. Marketing gripes that sales ignores their leads. Sales claims the leads are junk. It’s a familiar, expensive cycle of finger-pointing, wasted budget, and a funnel that leaks cash at every stage.

This isn’t about forcing your teams to have lunch together. It’s about re-architecting your revenue engine into a single, closed-loop system where everyone is accountable for the one metric that matters: revenue.

The cost of misalignment is staggering. According to HubSpot, companies with tightly aligned sales and marketing teams see 32% higher year-over-year growth. Those who don't? They actually see a 7% decrease. That's a nearly 40% performance gap you simply can't afford.

Stop the MQL vs. SQL War: Define the "Revenue-Ready Lead"

The first move is to declare a ceasefire in the linguistic battle. Terms like "MQL" (Marketing Qualified Lead) and "SQL" (Sales Qualified Lead) are often the root of the problem, meaning entirely different things to different people. You need to scrap them and create one universal definition that both teams build, own, and live by: the "Revenue-Ready Lead."

This isn't just another buzzword. A real Revenue-Ready Lead definition goes way beyond basic demographics. It's a precise contract based on tangible buying signals.

- •ICP Fit: Does this lead actually look like one of our best customers? (e.g., B2B SaaS, €5M+ ARR, 50-200 employees).

- •High-Intent Behavior: What actions prove they're actively in-market? (e.g., they didn't just download an ebook; they hit the pricing page, requested a demo, or binge-watched a case study).

- •Data Integrity: Do we have the critical info for a salesperson to have a real conversation? (e.g., verified phone number, correct job title, company size).

Getting this definition right completely changes the game. Marketing’s job is no longer to hit some arbitrary MQL quota. Their mission becomes generating leads that meet this exact, co-owned standard of quality.

Build the Operational Plumbing to Make Alignment Stick

With a shared definition locked in, you have to build the operational "plumbing" in your CRM to enforce it. This is where you move from good intentions to a system that forces collaboration and radical transparency. The contract that holds it all together is a Service Level Agreement (SLA).

"Your CRM should be the single source of truth for all customer-facing teams. If it's not in the CRM, it didn't happen. This simple rule eliminates 'he said, she said' and forces data-driven conversations." - A RevOps Leader at a prominent SaaS company.

Your SLA can't just be a dusty Google Doc. It needs to be wired directly into your CRM workflows.

The 30-Day SLA Implementation Sprint:

- •

Week 1: The Definition Workshop

- •Action: Get sales and marketing leaders in a room for a mandatory workshop. Map the current lead handoff process, warts and all.

- •Goal: Walk out with a documented, signed-off definition of a "Revenue-Ready Lead." No ambiguity allowed.

- •

Week 2: Configure the CRM and the Feedback Loop

- •Action: Set up automated lead routing in your CRM. The instant a Revenue-Ready Lead is created, it gets assigned. But here’s the critical part: build the bi-directional feedback loop.

- •Goal: When a salesperson rejects a lead, they must choose a reason from a dropdown menu (e.g., "Not a decision-maker," "Wrong timing," "No budget"). This is not optional.

- •Metric: 100% of rejected leads must have a disposition reason logged in the CRM.

- •

Week 3: Train the Teams and Go Live

- •Action: Hold separate training sessions for both teams. Show them the new process, the definitions, and exactly how to use the feedback system.

- •Goal: Everyone understands their part of the deal. Marketing delivers quality. Sales provides swift follow-up and feedback. Then, you flip the switch.

- •

Week 4: The First Review and Refine Meeting

- •Action: Host the first weekly SLA review meeting. Put the rejection data on the screen for everyone to see.

- •Goal: Turn data into action. Is one marketing campaign generating leads with "No budget"? Is a specific region underperforming? This data is pure gold. It allows marketing to refine targeting based on direct, real-time feedback from the front lines—not guesswork.

- •Metric: Marketing identifies at least one specific campaign tweak based on the CRM feedback data from the first week.

This four-week sprint transforms the dynamic from adversarial to collaborative. Marketing gets the unfiltered feedback it needs to deliver better leads, and sales gets a pipeline full of prospects they're actually excited to call. This isn't theory; it's how you build a robust operational system that becomes the engine of your revenue growth.

Implementing Quick-Win Revenue Growth Plays

Look, a long-term strategy is fantastic for building a predictable revenue machine, but you also need to put points on the board now. Quick wins do more than just boost the numbers—they build confidence across the company, self-fund your bigger projects, and prove that this new focus on revenue operations is actually working.

We're talking about generating a real return in weeks, not quarters. Forget boiling the ocean. Right now, it's all about high-impact, low-effort plays you can launch in the next 30 days to inject some immediate cash flow and energy into the pipeline. These are battle-tested tactics that don't require a complete system overhaul.

The Lead Revival Campaign

I guarantee your CRM is sitting on a goldmine of forgotten deals. I’m talking about those opportunities marked "closed-lost" from 6-9 months ago. The timing was off, the budget wasn't there, or they chose a competitor. Guess what? Things change.

This play is simple but shockingly effective. Don't send a generic "just checking in" email. That’s a waste of everyone's time. Instead, you re-engage them with a new, highly relevant reason to talk.

- •Find Your Targets: Pull a list of every opportunity marked "closed-lost" between 6 and 12 months ago. Filter out anyone who was a terrible fit for your product in the first place.

- •Craft a New Angle: Did you just launch a huge new feature that solves their original pain point? Have you published a case study in their exact industry? Your hook has to be fresh and genuinely valuable.

- •Launch a Simple Sequence: A simple 3-step email sequence is all you need. The goal isn't to re-pitch your entire product; it's to restart a conversation with new information.

We ran this exact play with a B2B SaaS client. They targeted deals lost due to "missing features" with an email announcing their new product module. The result? They reactivated four major accounts and closed an extra €50k in ARR in a single month.

Optimize Your Highest-Intent Pages

Your pricing, demo request, and comparison pages are where your hottest leads land. Every single second of friction on these pages costs you revenue. The mission here is to make it ridiculously easy for a motivated buyer to talk to a human right now.

You don't need a full website redesign for this. You can see massive gains by adding two simple tools.

- •Proactive Chatbots: Set up a chatbot to trigger only on these high-intent pages. Instead of a lame "Can I help you?" pop-up, script it with a qualifying question like, "Have a question about our enterprise plan? A specialist can answer live in 60 seconds."

- •Embedded Calendar Tools: Let prospects book a demo directly on the page without leaving. Kill every unnecessary form field. The easier you make it, the more meetings you'll book. Period.

For one Fintech client, simply adding a proactive chatbot and a one-click calendar booking tool to their pricing page boosted their qualified demo requests by 22% in the first month.

"Your website's pricing page isn't a brochure; it's a sales funnel. Every element should be ruthlessly optimized to reduce friction and accelerate the conversation with sales. Small tweaks here have an outsized impact on revenue."

The Strategic M&A Signal

While tuning your internal engine is critical, huge opportunities for revenue growth are created by external market shifts. A big one is the constant churn of mergers and acquisitions (M&A). When a company gets acquired or merges, budgets change, priorities get shuffled, and existing vendor contracts often come up for review—creating a perfect window for you to get in.

For example, the MEA region saw M&A transaction values hit $15 billion in Q1, a 35% jump from the year before. This isn't just a headline; it signals massive capital movement and strategic shakeups you can use as a trigger for outreach. You can dig into the specifics in the full M&A activity report from S&P Global.

These quick-win plays are about being tactical and opportunistic. They deliver measurable results fast, building the case for the deeper, more structural changes you'll make to your revenue operations down the line.

Building the Data Infrastructure for Scalable Growth

Your RevOps system is only as good as the data that fuels it. A brilliant strategy executed with messy, unreliable data will always fail, leaving you with conflicting reports and zero confidence in your numbers.

This is where you build the foundation for real, scalable revenue growth. Forget fancy dashboards for a moment. The goal is to establish a simple, reliable data and automation stack that amplifies truth, not noise.

The entire system hinges on one core principle: creating a single source of truth (SSoT) for all revenue data. For virtually every B2B SaaS and Fintech company, this has to be your CRM. When marketing, sales, and customer success all pull their numbers from different platforms, you get chaos. One team reports a 20% conversion rate while another sees 12%—who do you believe?

Establishing your CRM as the undisputed SSoT eliminates this ambiguity. If a deal's status isn't updated in the CRM, it didn't happen. This simple rule forces discipline and creates a unified view of the entire customer journey, from the first marketing touch to renewal.

From Messy Data to a Clean Revenue Engine

Data hygiene isn't glamorous, but it's the bedrock of predictability. Inaccurate or incomplete data leads to flawed forecasts, wasted marketing spend, and sales reps chasing dead-end leads. It’s like trying to navigate a new city with a map from 1980; you'll get hopelessly lost.

You need a systematic process for keeping your data clean. A quarterly data audit is non-negotiable.

Your Quarterly Data Hygiene Checklist:

- •Duplicate Records: Run a de-duplication report for contacts and companies. Merging these is a quick win that prevents reps from stepping on each other's toes.

- •Incomplete Fields: Identify critical fields (e.g., industry, company size, phone number) that are frequently empty and create a plan to populate them.

- •Stale Opportunities: Flag all deals that have been sitting in the same pipeline stage for more than your average sales cycle length. These are often dead but are artificially inflating your pipeline.

- •Ownership Gaps: Ensure every active contact and account has a designated owner. This simple check stops leads from falling through the cracks.

A clean CRM is the first step. The next is using that clean data to drive intelligent action through automation.

Using Automation to Amplify Human Intelligence

Automation in RevOps isn't about replacing your team; it's about making them smarter, faster, and more focused on what they do best. It’s the operational plumbing that ensures your strategy is executed consistently, every single time. This is a crucial concept we explore in our guide to effective Revenue Operations.

Here’s a snapshot of a Salesforce dashboard, a common CRM used to centralize and visualize this kind of critical revenue data.

Dashboards like this provide the high-level view, but the real power comes from the automated workflows running underneath that ensure the data is accurate and actionable.

The value of robust data infrastructure is clear, especially in high-growth markets. The data analytics market in the Middle East and Africa, for instance, generated USD 5,938.5 million in revenue and is projected to grow at a CAGR of 16.8% through 2030. This incredible growth highlights a massive regional investment in turning data into a competitive advantage. You can discover more insights about the MEA data analytics market trends from Grand View Research.

"AI amplifies truth, not noise. Your goal should be to build systems that show what’s actually working, so your team can focus on high-value conversations instead of manual data entry."

Consider these practical automation plays you can implement right away:

- •Instant Lead Routing: When a high-intent lead fills out a demo request form, automation should instantly check for ownership, assign it to the right rep based on territory or segment, and create a task in the CRM. This kills the lead response time black hole where hot leads go cold.

- •AI-Powered Conversation Intelligence: Tools like Gong or Chorus can analyze sales calls to identify which talk tracks and competitor mentions correlate with higher win rates. This isn't about micromanaging reps; it’s about giving them a data-backed blueprint of what "good" sounds like.

- •Pipeline Hygiene Alerts: You can build a simple workflow that automatically alerts a sales manager when a deal has been stuck in a stage for too long. This turns pipeline reviews from a manual chore into a proactive, exception-based process.

This practical, no-nonsense data infrastructure is the engine of scalability. It ensures your team is working with clean data, executing the right plays consistently, and focusing their time on activities that actually generate revenue.

Your Actionable 6-Week Revenue Growth Sprint

Theory is great, but talk doesn't move the needle on ARR. This is where we turn strategy into action with a tangible, 6-week sprint designed to build momentum and deliver real, measurable improvements to your revenue engine.

Think of this less as a one-time fix and more as the first turn of the flywheel—a repeatable system for predictable growth. Each week has a razor-sharp focus, clear activities, and defined success metrics. No ambiguity, just a clear path from diagnosis to action.

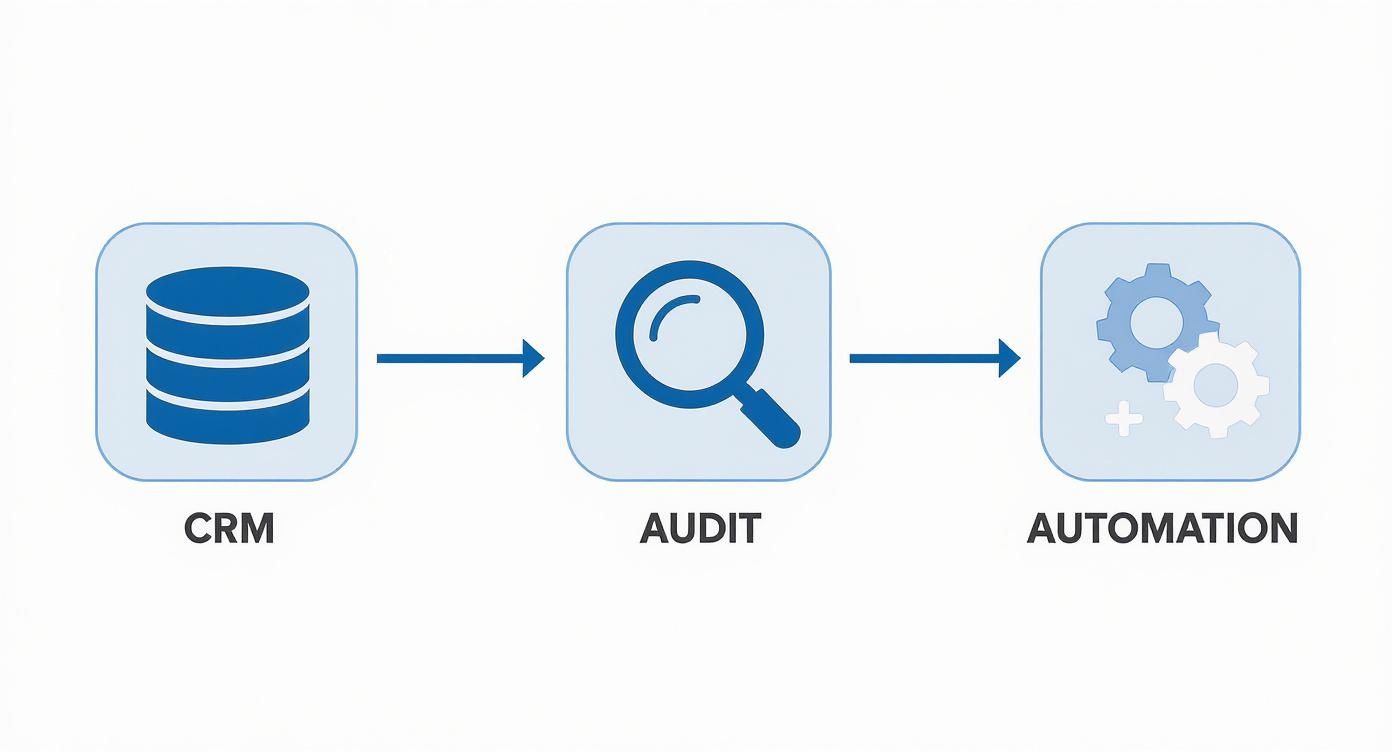

This process is all about fortifying your data infrastructure. It starts with your CRM as the single source of truth, moves through a rigorous audit to find the leaks, and ends with scalable automation that plugs them for good.

Infographic about Revenue Growth

The visual drives home a critical point I've seen play out dozens of times: solid data, verified by an audit, is the non-negotiable foundation for any automation that actually drives growth.

The 6-Week Implementation Plan

- •

Week 1: The Diagnostic Audit. Your first job is to get brutally honest about what's really happening in your funnel. Using the diagnostic checklist from Section 2, you're going to pull real data from your CRM to quantify everything from lead response times to pipeline stall rates. Success Looks Like: A completed audit report that pinpoints your top three revenue leaks.

- •

Week 2: Quick-Win Implementation. Momentum is everything. Pick one high-impact, low-effort play from Section 4—something like the Lead Revival Campaign—and get it out the door. The goal here is speed and immediate feedback. Success Looks Like: The campaign is live and you're already seeing the first responses roll in.

- •

Weeks 3-4: Sales & Marketing Alignment. This is the make-or-break phase. For the next two weeks, you'll run the 30-day SLA workshop detailed in Section 3. You'll hammer out a universal definition for a "Revenue-Ready Lead" and build that bi-directional feedback loop right inside your CRM. Success Looks Like: A signed-off SLA and a functional feedback system that both teams actually use.

- •

Week 5: Data Fortification. With a new process in place, you have to make sure your tracking is airtight. This week is for reinforcing your CRM data tracking and attribution models so you can accurately measure the new SLA and its impact. Success Looks Like: Dashboards are built and live, monitoring the new lead handoff process in real-time.

- •

Week 6: Review & Iterate. Time to look at the scoreboard. Analyze the results from your quick-win play and the initial data from your new SLA metrics. Figure out what worked, what didn't, and what you learned. This informs the focus for your next cycle. Success Looks Like: A data-driven plan for the next sprint is locked in.

We've run this playbook before, and it's not uncommon to see a 15–25% improvement in pipeline velocity within the very first cycle. This structured approach creates a rhythm of continuous improvement that turns sporadic wins into a predictable system.

This sprint is about applying a rigorous, proven framework to your business. To see how we can guide you through this process, learn how the 6-Week Revenue Growth Sprint applies this framework to your business.

Got Questions? We've Got Answers

You've got the playbook, but a few questions are probably rattling around in your head. That’s normal. Here are some of the most common ones we hear from founders and revenue leaders before they dive in.

How Long Until We Actually See Results?

This is the big one, isn't it? Let’s be direct: foundational changes, the kind that build a predictable revenue machine, take a full quarter to really mature and show up in your ARR.

But you won't be waiting 90 days for a win. Some of the "quick-win" plays in this guide can deliver a measurable impact within 30 days. For instance, simply optimizing your lead routing and enforcing response time SLAs can boost lead contact rates by 10-15% in the first month. We've seen it happen time and again.

Within a single 6-week sprint focused on a specific bottleneck, you should expect to see a 15-25% improvement in pipeline velocity. The key is to see this not as a one-and-done project, but as the kickoff for a continuous cycle of improvement.

What's the Single Biggest Mistake Companies Make with Revenue Growth?

Chasing the wrong metrics. Hands down.

The most common trap is a relentless focus on top-of-funnel vanity metrics—things like MQL volume or website traffic—instead of metrics that are actually tied to revenue. It’s a classic case of prioritizing volume over quality, and it always ends the same way.

This mistake creates a massive disconnect. Marketing hits its MQL target and celebrates, while sales is drowning in leads they can't close. The result is a leaky funnel and a whole lot of finger-pointing. The fix? Build a unified system where both teams are accountable for revenue outcomes, starting with a shared, data-backed definition of a "revenue-ready lead."

Can We Do This Without a Dedicated RevOps Person?

Absolutely. In fact, most companies don't start with a dedicated hire. Think of RevOps as a function before it's a person or a department.

You can get started by assigning clear ownership of the "revenue system" to a leader in your existing sales or marketing operations team. Use the frameworks in this guide as your roadmap to run a cross-functional project.

The critical first step is getting buy-in from both sales and marketing leadership. They need to agree to prioritize the alignment and data infrastructure work. We’ve seen many companies successfully implement this entire playbook well before they hire their first dedicated RevOps manager.

Ready to stop guessing and start building a predictable system for revenue growth? The frameworks in this guide are the core of our diagnostic process at Altior & Co.

Learn how the 6-Week Revenue Growth Sprint applies this playbook directly to your business. Find out more at https://altiorco.com.