Discover how crm audit for saas boosts revenue, fixes leaks, and optimizes data hygiene, processes, and your tech stack with actionable steps.

So, what exactly is a CRM audit for SaaS? Think of it as a strategic diagnostic—a deep-dive inspection designed to uncover and fix the hidden cracks in your customer relationship management system. This isn't just a technical check-up. It's a comprehensive review of your data, workflows, and funnel metrics to stop revenue leaks, get sales and marketing on the same page, and build a growth engine you can actually count on.

Your CRM Is Silently Leaking Revenue

For most SaaS leaders, the CRM feels like a necessary evil. You believe it's the single source of truth for your entire go-to-market performance, but in reality, it’s a chaotic mess of outdated contacts, confusing workflows, and reports that nobody on the team trusts.

Here’s the uncomfortable reality: your CRM is a direct reflection of your revenue engine. Every outdated record, every manual process, and every data gap is a tiny crack in your company's foundation. These aren't just minor admin headaches. They are active revenue leaks, silently siphoning profit from your pipeline every single day.

A business professional analyzing data on a laptop with charts and graphs, highlighting 'STOP REVENUE LEAK'.

The Dangerous Gap Between Perception and Reality

The biggest risk isn't what you know is broken; it's the gap between what your leadership team thinks is happening and what the data actually says. Sales leaders might report 80% follow-up compliance, but CRM data shows only 25% of MQLs are touched within the first 24 hours. Your Head of Sales might be forecasting a record quarter, but rock-bottom pipeline coverage tells a very different story.

This is where predictable growth goes to die.

A CRM audit for SaaS is the tool that closes this gap. It yanks you out of the world of guesswork and into the world of certainty by exposing these hidden problems and putting a number on their financial impact. For instance, in our audits for European B2B SaaS scale-ups, we often find MQL-to-SQL conversion rates stuck between 15-21%. Meanwhile, top performers, as noted by publications like SaaStr, are consistently hitting 40%.

That's not just a percentage difference—it's a massive revenue opportunity being squandered due to process friction and messy data.

The table below shows just how jarring the difference between perception and reality can be. It's a common theme we see before any audit begins.

The Perception vs. Reality Check From Your CRM Data

| Metric | Common Leadership Perception | Typical Reality Found in a CRM Audit |

|---|---|---|

| Lead Response Time | "Our reps contact new leads within the hour." | Average response time is 8-24 hours; 30% of leads are never contacted. |

| Pipeline Coverage | "We have 3x pipeline coverage for next quarter." | Actual coverage is 1.8x once stale and unqualified deals are removed. |

| Marketing Attribution | "Our latest webinar generated 50 new opportunities." | Only 5 opportunities have moved past the first stage; attribution is last-touch. |

| Sales Cycle Length | "Our average sales cycle is 90 days." | The median is 125 days, skewed by a few fast deals. |

| Data Accuracy | "Our contact data is mostly up-to-date." | 40% of contact records are missing key data points or have outdated info. |

Seeing the data laid out like this is often the wake-up call that prompts immediate action.

Why Your Current Approach Isn't Working

Too many teams try to patch these problems with more meetings or by throwing another piece of tech at the wall. But that just adds more noise to an already broken system. Without a proper diagnostic, you're just treating symptoms, not the root cause. This is exactly why identifying and fixing revenue leakage has to be the first step before launching any other major growth initiative.

A proper audit gives you the clarity you need to make decisive, confident moves. It helps you answer the fundamental questions that your business depends on:

- •How long does it really take to contact a new lead?

- •Which marketing channels are actually generating pipeline, not just clicks and downloads?

- •Is our sales team spending their time selling, or are they stuck fighting the CRM?

By answering these questions with real data, you can finally transform your CRM from a chaotic database into a strategic asset that actually fuels your growth.

Auditing Your Funnel Metrics and Pipeline Health

Dashboards and sprawling reports can create more confusion than clarity. A proper CRM audit for SaaS isn't about pulling every report possible; it's about cutting through the noise to find the handful of metrics that truly define the health of your revenue engine. This is how you transform raw data into a clear story, showing you exactly where your funnel is strong and where it’s leaking cash.

Forget vanity metrics. Your audit needs to zero in on the vital signs of your go-to-market motion. By inspecting these core numbers, you can quickly diagnose issues that are otherwise invisible.

A screen displaying 'Funnel Health' with a sales funnel diagram in a conference room with green chairs and a speaker.

The Five Critical Funnel Metrics to Audit

For a B2B SaaS company in the €8-10M ARR range, performance hinges on a few key conversion points. Let's look at what ‘good’ looks like and how to spot trouble brewing in your CRM.

- •

Visitor-to-Lead Rate: This top-of-funnel number tells you how well your website is capturing interest. For most SaaS businesses, a healthy rate is around 2-5%. If you're dipping below that, it could signal a disconnect between your marketing message and target audience, or just too much friction in your demo request form.

- •

MQL-to-SQL Conversion Rate: This is where the crucial sales and marketing handover happens. A strong conversion rate here is typically 25-40%. Anything below 15% is a major red flag, often pointing to a misaligned definition of a "qualified lead" or—more commonly—a slow handoff that lets warm leads go cold.

- •

Sales Cycle Length: Time kills all deals. It's a cliché for a reason. HubSpot pegs the average B2B SaaS sales cycle at around 84 days. If yours is creeping past 100, your audit needs to pinpoint exactly where deals are stalling. Is it a slow demo-to-trial process or a bottleneck in legal and negotiation?

- •

Pipeline Coverage: This metric reveals just how reliable your forecast really is. The standard benchmark is 3x coverage—meaning you have three times the pipeline value needed to hit your quarterly target. An audit often reveals the "perceived" pipeline is bloated with stale deals. After a cleanup, many teams are shocked to find their true coverage is closer to a dangerous 1.5-2x. Improving your pipeline management is absolutely critical for predictable growth.

- •

Average Deal Size (ADS): While this varies wildly, tracking ADS by lead source or sales rep is vital. A declining ADS might mean reps are heavily discounting to close deals at the end of the quarter, or that marketing is starting to attract smaller, less ideal customers.

Expert Insight: "We had a client whose MQL-to-SQL rate was a dismal 12%. The audit revealed a 48-hour average delay between a lead hitting the CRM and a rep making first contact. By implementing an automated round-robin assignment with a 2-hour SLA, they boosted that conversion rate to 28% in six weeks, uncovering an estimated €250k in previously lost annual pipeline."

The 3-Question Bottleneck Finder Framework

Once you have your core metrics, don't just stare at them. Use this simple framework to turn data into action and find exactly where your funnel is leaking revenue. For each metric that falls below the benchmark, get your team in a room and ask these three questions.

- •

Question 1: Where is the friction? (Process)

- •Example: For a low MQL-to-SQL rate, is the friction in the manual lead assignment process? Is our MQL scoring criteria too vague for reps to trust?

- •

Question 2: Who owns the fix? (People)

- •Example: Does Marketing Ops own the lead scoring model? Does the Head of Sales own the rep follow-up SLA? Assigning a clear owner is non-negotiable. Ambiguity is the enemy of execution.

- •

Question 3: How do we measure success? (Technology & Metrics)

- •Example: Can we build a dashboard in our CRM to track lead response time in real-time? Success will be defined as "reducing average lead response time to under 2 hours within 30 days."

This framework shifts the conversation from "our numbers are bad" to "here is our specific plan to fix the problem." It makes the audit tangible and connects every data point to a concrete, measurable business outcome. Your CRM isn't just a database; it’s a diagnostic tool waiting to show you the path to more predictable revenue.

Assessing Your Data Hygiene and Process Integrity

After you've figured out what's broken in your funnel, the next move in your CRM audit for SaaS is to uncover why. This is where you pivot from looking at high-level metrics to digging into the foundation they're built on: your data hygiene and process integrity. It's the classic shift from treating the symptom to finding the root cause.

Let's be blunt: poor data isn't just a messy spreadsheet. It's a silent killer of growth. It completely tanks your marketing attribution, makes a mockery of sales automation, and systematically destroys any trust in your reporting. When your reps don't trust the info in front of them, they stop using the CRM altogether. Your single source of truth quickly becomes a data graveyard. This slow decay is precisely why mastering CRM hygiene is non-negotiable for predictable growth.

Tablet with 'Data Hygiene' text, displaying a form with checkboxes on a wooden desk with office supplies.

Connecting Messy Data to Lost Revenue

Every single inconsistent field or duplicate record has a real business cost. Vague "Close Reason" fields? That just means you never learn why you're actually losing deals. Inconsistent deal stage definitions? Get ready for wildly inaccurate sales forecasts that leave your leadership team flying blind.

Here’s a scenario we see all the time: a company’s lead routing rules are a tangled mess of old assignments from reps who left years ago. The result is that high-intent leads from key European markets sit untouched for days, while the right reps never even know they exist. This isn't just a process flaw; it's actively burning your marketing budget and gift-wrapping qualified pipeline for your competitors.

A recent Altior audit for a fintech scale-up uncovered that over 30% of their contact records were duplicates. This wasn't just untidy—it meant marketing was sending conflicting messages while sales reps were unknowingly calling the same accounts. The result was a terrible customer experience and hundreds of wasted selling hours each quarter.

Key Areas for Your Data and Process Audit

To give your assessment some structure, focus on the areas where bad data causes the most damage. This isn't about chasing perfection. It's about enforcing consistency where it matters most for hitting your revenue targets. And before you dive deep, check out our complete guide on how to perform a comprehensive CRM audit focused on data hygiene for a more detailed checklist.

Your initial sweep should cover these hot spots:

- •Data Entry Completeness: Are mission-critical fields like "Lead Source," "Industry," and "Company Size" consistently filled out? If not, any attempt at segmentation or targeted campaigns is dead on arrival.

- •Deal Stage Integrity: Does everyone on the sales team define deal stages the same way? If "Negotiation" means one thing to one rep and something totally different to another, your pipeline is pure fiction.

- •Ownership Protocols: Are there crystal-clear rules for account and lead ownership? Any ambiguity here leads to internal conflicts and, far worse, valuable leads falling through the cracks with no one assigned to follow up.

- •Duplicate Records: Hunt down duplicate contacts, companies, and deals. They don't just skew your reports; they lead to embarrassing and wildly inefficient go-to-market motions.

The 5-Minute Data Spot-Check Tactic

You don't need to block out a full week to get a quick pulse on your data's health. Use this simple diagnostic to see how big the problem really is.

- •Pull a Sample: Randomly select 20 contact or lead records created in the last 30 days.

- •Scan for Completeness: How many are missing basic information like a phone number, job title, or lead source?

- •Check for Activity: How many have zero logged calls, emails, or tasks tied to them? This is a massive red flag for low user adoption.

In just five minutes, this little spot-check gives you a tangible snapshot of your data integrity. If you find that 10 out of 20 records are incomplete or have gone cold, you’ve got a serious problem on your hands. This goes way beyond simple untidiness—it's actively kneecapping your ability to grow.

Evaluating Your Tech Stack and Integrations

Your CRM isn’t an island. It’s the central nervous system for your entire go-to-market motion, connected to marketing automation, sales engagement tools, and customer success platforms. This means a real CRM audit for SaaS has to look beyond the CRM itself and scrutinize the entire ecosystem. Broken data flows and clunky integrations create invisible walls between your teams, quietly sabotaging your revenue engine.

This is where you start mapping your go-to-market architecture. The goal is to follow the data from system to system, sniffing out the bottlenecks, broken syncs, and risky manual workarounds that are holding you back. A huge piece of this is digging into all your current CRM integrations to make sure they’re actually pulling their weight and keeping data consistent. Without this, you're making big decisions based on a fragmented, unreliable picture of your business.

Uncovering Shadow IT and Hidden Risks

One of the sneakiest problems we find during audits is Shadow IT—all the unauthorized tools and apps your teams are using without anyone’s approval. A salesperson might be using their favorite scheduling link or a marketer connects a new analytics tool, and suddenly you have a data governance nightmare and a gaping security hole.

These rogue tools operate completely outside your control, racking up hidden costs and creating serious compliance risks. In fact, 59% of EU IT teams are worried about these unauthorized apps, and 21% of companies have found user-added SaaS flying completely under the radar. This isn't just an IT problem; it's a CRM health crisis. A shocking 63% of security issues come from simple SaaS misconfigurations. You can find more of these critical SaaS statistics on BetterCloud.com.

For founders, this is a massive blind spot. Our audits often uncover that 56% of employees are uploading sensitive company data to tools we have zero visibility into. With over 60% of data breaches tied to compromised credentials, a thorough tooling audit isn't just good practice—it's non-negotiable for protecting your company.

The Tool ROI and Burden Framework

Tool bloat is another classic symptom of a messy stack. Teams adopt new software with the best of intentions, but it often just becomes another silo that creates more admin work than it solves. Your audit needs to force a tough conversation about the real value each tool is delivering.

The best way to do this is with a simple evaluation framework. For every major tool plugged into your CRM (think HubSpot, SalesLoft, Gong), you need to ask two direct questions:

- •What is the ROI? Can we prove this tool measurably improves a key metric, like conversion rate, sales cycle length, or rep efficiency? We have to get past "it feels useful" and get to "it increased our demo-to-close rate by 5%."

- •What is the administrative burden? How many hours a week does the team spend managing, updating, and troubleshooting this tool? If the burden is heavier than the benefit, it's time to think about cutting it loose.

This simple exercise forces you to justify every subscription with hard data. It’s how you separate the tools that give you real leverage from the ones that just add noise and complexity.

Mapping Your Data Flows

The final piece of the puzzle is to create a visual map of how your data moves. This doesn't have to be some complex technical diagram. A simple flowchart is often enough to show you exactly where information gets stuck, corrupted, or lost between your systems.

Start by tracing the journey of a single lead:

- •Capture: Where does a lead first enter your world? (e.g., a form on your HubSpot landing page)

- •Sync: How does it land in your CRM? Is that transfer instant and complete, or is there a delay?

- •Enrichment: Which tools add more context? (e.g., Clearbit, ZoomInfo)

- •Engagement: How does the sales team actually use this data to connect with the lead? (e.g., sequences in SalesLoft or Outreach)

- •Conversion: How is the deal tracked once it becomes a real opportunity in the pipeline?

Walking through this process will immediately expose the gaps. You might find that lead scores from your marketing platform aren't syncing to the CRM, leaving your reps flying blind. Or maybe critical product usage data isn't making its way to your customer success team's platform. For a deeper look at how these pieces should fit together, check out our guide on building your complete revenue operations tech stack for B2B SaaS. Fixing these broken links is how you build a seamless customer journey and a revenue operation that truly runs on data.

Building Your Prioritized Remediation Roadmap

An audit that just sits on a shelf is an academic exercise, not a growth strategy. The real value of a CRM audit for SaaS isn't in the findings themselves, but in the focused action they drive. This is where you shift from diagnosis to prescription, turning a laundry list of issues into a concrete, week-by-week plan your entire go-to-market team can get behind.

The goal here is to stop boiling the ocean. Forget trying to fix everything at once. You need a system to prioritize what delivers the most value, the fastest. This approach prevents overwhelm and builds momentum by stacking quick, meaningful wins.

The Impact vs. Effort Prioritization Matrix

The simplest way to bring order to the chaos is with a classic 2x2 prioritization matrix. It’s a battle-tested framework that forces you to evaluate every potential fix against two straightforward questions:

- •What’s the business impact? (High or Low)

- •What’s the implementation effort? (High or Low)

This simple exercise immediately clarifies your path forward.

- •

High Impact, Low Effort (Quick Wins): These are your immediate priorities. Think about creating an automated round-robin rule for lead assignment or cleaning up your deal stage definitions. They deliver instant value without requiring a massive project.

- •

High Impact, High Effort (Major Projects): These are the big, strategic initiatives, like a full data migration or implementing a new marketing automation platform like Marketo. They demand careful planning and dedicated resources.

- •

Low Impact, Low Effort (Fill-ins): These are the small housekeeping tasks. Tackle them when you have downtime, but don't let them distract from more important work.

- •

Low Impact, High Effort (Time Sinks): Avoid these at all costs. They chew up huge amounts of time and deliver almost no measurable return on that investment.

An audit without a roadmap is just a list of complaints. A roadmap turns those complaints into a committed plan for revenue growth, with names and dates attached.

Turning Findings Into a Living Document

Your remediation roadmap can't be a static PDF that gets buried in a Google Drive folder. It has to be a living document—a project plan with clear columns that drive accountability. This approach transforms your audit from a one-time event into an ongoing operational rhythm.

Each item on your roadmap needs these five components:

- •The Identified Issue: Be specific. Not "bad data," but "40% of leads are missing a Lead Source."

- •The Proposed Solution: The concrete action you'll take. "Implement a mandatory, pick-list 'Lead Source' field on the lead creation form."

- •The Owner: Who is responsible for getting this done? (e.g., Sales Ops, Marketing Ops).

- •The SLA for the Fix: A clear service-level agreement or deadline. "Reduce lead response time to <2 hours."

- •The Success Metric: How you will measure the outcome. "Increase MQL-to-SQL conversion by 15% within 60 days."

This structure kills ambiguity. It forces your team to align on the problem, the solution, the owner, and the definition of success before any work begins.

For EU-based B2B SaaS firms, this process is especially critical for plugging vulnerabilities that drive churn. With an average monthly B2B churn rate of 6.7% and 30% of firms seeing that number rise, fixing leaky CRM processes is a retention imperative. Audits often reveal that while SEO might drive up to 60% of the pipeline, a poor demo-to-close rate of 15-25% negates those gains. And with 67% of buyers now self-serving before speaking to sales, a well-oiled CRM is essential for meeting their expectations. You can discover more about these customer success statistics on Custify.com.

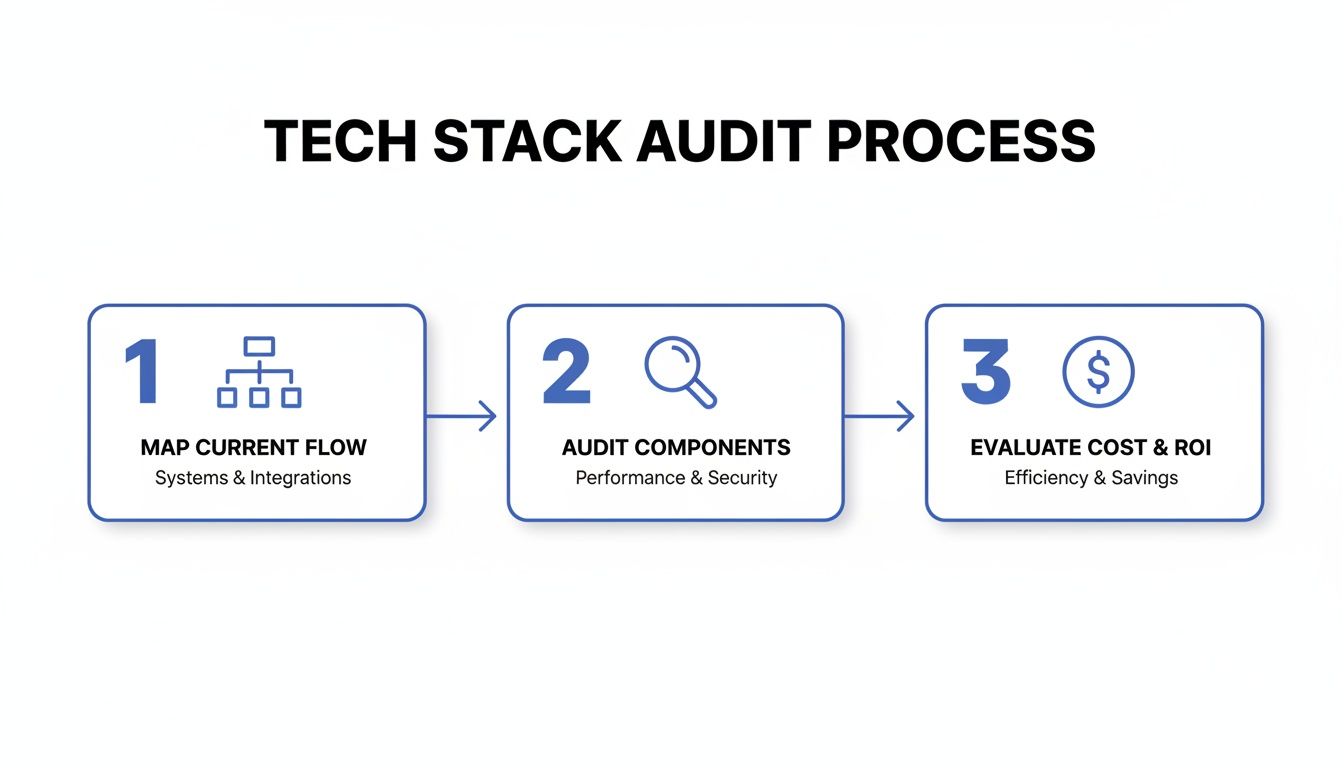

A three-step tech stack audit process flow: map current flow, audit components, evaluate cost and ROI.

A Sample 6-Week Remediation Sprint

Your roadmap brings all these pieces together into an actionable timeline. It’s not about some multi-year transformation; it's about making tangible progress in measurable sprints.

Here’s a high-level look at how you can sequence your audit findings into a powerful 6-week plan. This isn't just a to-do list; it's a project plan designed to deliver measurable results, fast.

Sample 6-Week CRM Remediation Plan

| Week | Focus Area | Key Actions | Owner | Success Metric |

|---|---|---|---|---|

| Weeks 1-2 | Quick Wins & Foundation | Implement automated lead routing. Standardize top 5 data fields. De-duplicate top 50 accounts. | Sales Ops | Lead Response Time <2 hours |

| Weeks 3-4 | Process & Workflow | Redefine and document deal stages. Build a dashboard for MQL-to-SQL conversion. | RevOps Lead | 95% deal stage adherence |

| Weeks 5-6 | Adoption & Automation | Train sales team on new processes. Automate 3 key data entry tasks. | Head of Sales | 80% user login rate |

This phased approach ensures you're not just creating a plan but actively executing it. By the end of this sprint, you won't just have a cleaner CRM; you'll have a more predictable revenue engine, setting the stage for the next phase of your growth.

Common Questions About Your CRM Audit

Even with a clear roadmap, questions always pop up when you start digging into a CRM audit for SaaS. That’s completely normal. Getting this right means challenging old assumptions and shining a light on parts of the business that might have been ignored for too long.

Here are some straight answers to the questions we hear most from founders and RevOps leaders.

How Often Should We Conduct a CRM Audit?

For a fast-growing SaaS company hitting that €8-10M ARR mark, a full-scale CRM audit needs to be an annual strategic initiative. Your go-to-market strategy, team structure, and tooling are changing too quickly for anything less. Processes that worked flawlessly just six months ago can become serious bottlenecks almost overnight.

But you can't wait a full year to check the vital signs. Think of a lighter 'health check' as a quarterly ritual. This focused review should zoom in on your most critical funnel metrics—like MQL-to-SQL conversion and lead response times—and basic data hygiene, such as duplicate rates. These quarterly checks ensure you spot and fix revenue leaks before they compound and throw you off your growth trajectory.

What Are the Biggest Red Flags to Look For?

While every audit uncovers unique issues, a few universal red flags almost always point to deeper problems. If you see these, you need to dig in immediately.

The top three are:

- •An inflated sales cycle length. If your average sales cycle is creeping significantly past the industry benchmark of around 84 days, it’s a clear sign of friction. This could be a slow handoff between SDRs and AEs, a clunky demo process, or a logjam in the final negotiation stage.

- •A low MQL-to-SQL conversion rate. Anything below 15% is a serious cause for concern. It almost always signals a fundamental misalignment between marketing and sales on what a "qualified" lead actually is, or a painfully slow handoff process that lets your warmest leads go cold.

- •A high number of overdue tasks and unlogged activities. This is the clearest sign of low user adoption. If your reps aren't living in the CRM, your data is incomplete and unreliable, making accurate forecasting and strategic decision-making impossible.

We recently audited a client who thought their sales cycle was 90 days. The data showed the median was actually 125 days, skewed by a handful of unusually fast deals. The culprit? A three-week delay in the legal review stage, an issue that was completely invisible until the audit brought it to light.

Can We Perform a CRM Audit In-House?

An in-house audit is definitely possible, but only if you have a dedicated RevOps function with the specific experience and bandwidth to do it right. For many scale-ups, that’s just not realistic.

Hiring an external expert or a specialized firm brings three clear advantages to the table:

- •Speed: An experienced consultant can run a complete audit and deliver a prioritized roadmap in weeks, not months. Internal teams often get pulled into day-to-day fires, dragging the process out.

- •Benchmarking: External partners bring invaluable context. They can tell you not just what your metrics are, but how they stack up against hundreds of other similar SaaS companies.

- •Objectivity: A third party can navigate internal politics and drive alignment between sales, marketing, and leadership without bias. They can ask the tough questions and push for changes an internal employee might find difficult.

Ultimately, the decision comes down to a simple trade-off. You need to weigh the internal cost of your team's time and the risk of missed insights against the direct investment in external, specialized expertise.

At Altior & Co., we transform your CRM audit from a technical chore into a strategic growth lever. After implementing this framework, you can expect a 15–25% improvement in pipeline velocity within 6 weeks. Our 6-Week Revenue Growth Sprint provides the data, benchmarks, and actionable roadmap you need to stop revenue leaks and build a predictable growth engine.

Learn how the 6-Week Revenue Growth Sprint applies this framework to your business