Discover Customer Success strategies for scalable B2B SaaS growth, with proactive teams and key metrics that boost retention and revenue.

Are you tired of hearing that Customer Success is just a fancier name for your support team? It’s not. It's the proactive engine that drives revenue growth by ensuring your customers get the value you promised them. Think of it as the critical bridge between your sales pitch and the real-world results that create customers for life. If your Customer Success team isn't directly contributing to Net Revenue Retention (NRR), you're leaving money on the table.

What Is Customer Success, Really?

Man watching a 'Customer Success' presentation on a computer, taking notes at a wooden desk.

For a scaling B2B SaaS or fintech company, standing up a real Customer Success function is a defining moment. It marks the shift from treating everything post-sale as a cost center to recognizing it as a powerful profit driver. It’s the difference between plugging a leaky revenue bucket and turning that bucket into a growth engine.

While your support team is absolutely essential, they’re fundamentally reactive—they solve problems as they come in. They’re the firefighters.

Customer Success, on the other hand, is the fire marshal. Their entire mission is to anticipate your customers' needs, guide them toward their goals, and systematically prove your solution’s value. This approach transforms your business from one focused purely on landing new logos to one balanced on keeping and growing the customers you already have.

Customer Support vs. Customer Success: A Fundamental Shift

To truly grasp the difference, you need to see how their core functions, goals, and metrics diverge. Support is about fixing immediate problems; Success is about delivering long-term value.

| Dimension | Customer Support (Reactive) | Customer Success (Proactive) |

|---|---|---|

| Primary Goal | Resolve issues and answer questions quickly. | Ensure customers achieve their desired business outcomes. |

| Key Metrics | Ticket resolution time, first contact resolution, CSAT. | Net Revenue Retention (NRR), LTV, product adoption, customer health score. |

| Mindset | "How can I fix this problem for you?" | "How can I help you achieve your goals with our product?" |

| Business Impact | Reduces customer frustration, maintains baseline satisfaction. | Drives revenue through retention, expansion, and advocacy. |

| Timeline | Short-term, transactional interactions. | Long-term, strategic relationship building. |

This isn't just a semantic difference; it's a completely different philosophy that has a massive impact on your bottom line.

Why This Matters for Revenue Operations

From a Revenue Operations perspective, Customer Success is the team that protects and expands the revenue you’ve already fought so hard to win. They are the guardians of your recurring revenue stream.

When CS is disconnected from the rest of your revenue engine, you get a leaky bucket. New logos pour in the top while unhappy, unengaged customers quietly slip out the bottom, tanking your net retention.

A reactive support model waits for a customer to file a ticket. A proactive success model analyzes usage data to spot a customer who is struggling before they even realize it—and intervenes. That’s the core difference.

Instead of just measuring ticket times, a mature CS function obsesses over leading indicators of churn and opportunity. They focus on metrics that directly impact your company’s valuation, like:

- •Net Revenue Retention (NRR): The ultimate measure of customer health, showing how much revenue you retain and grow from your existing base.

- •Customer Lifetime Value (LTV): Proving that a happy, successful customer spends more over their entire relationship with your company.

- •Product Adoption Rates: Ensuring customers use the sticky features that deliver the most value, making them far less likely to churn.

As Jason Lemkin, founder of SaaStr, famously stated, "Customer Success is where 90% of the revenue is." This isn't just a catchy phrase; it's a mathematical reality for SaaS businesses built on recurring revenue.

By weaving CS into your RevOps framework, you create a powerful feedback loop. You can monitor key health indicators and take action before a customer is at risk. This proactive stance doesn't just plug the leaks in your revenue bucket; it turns your satisfied customers into your most effective growth channel through renewals, upsells, and advocacy.

How to Structure Your Customer Success Team

People in an office collaborating on a whiteboard with a 'Team Structure' diagram and flowchart.

Here’s a hard truth: the high-touch, "all-hands-on-deck" Customer Success model that got you to your first €1M ARR will break as you scale. Relying on it for too long leads to burned-out CSMs and wildly inconsistent customer experiences. You have to evolve.

Your goal is to build a system that delivers the right level of engagement to the right customer at the right time. Get this wrong, and you're either over-investing in small accounts or under-serving strategic partners. Both scenarios kill your Net Revenue Retention (NRR).

This isn't just a hypothetical problem. According to a HubSpot survey, 68% of customers are willing to pay more for products and services from a brand known for good customer service experiences. The desire for structured, proactive engagement is clear.

Choosing Your Customer Success Model

Once you cross the €5M ARR mark, the generalist model where every CSM does everything becomes a liability. The right structure depends entirely on your customer base, product complexity, and average contract value (ACV).

- •Pooled Model (Low-Touch): This is your answer for a high volume of low-ACV customers. Instead of a dedicated CSM, customers get support from a team. It’s a "one-to-many" approach using automated onboarding emails, webinars, and a solid knowledge base.

- •Segmented Model (Mid-Touch): This is the go-to model for most scaling B2B SaaS companies. You group customers into tiers based on ARR or strategic value. Your top tiers get a dedicated CSM, while lower tiers might share one or get a pooled experience.

- •Strategic/Enterprise Model (High-Touch): Reserved for your biggest, most valuable accounts. These customers get a dedicated Strategic CSM who functions more like a consultant—building deep relationships, crafting custom success plans, and leading Executive Business Reviews (EBRs).

The key isn't to pick one model and stick with it. It's to build a hybrid structure that serves your entire customer base efficiently. Your top 20% of accounts probably drive 80% of your revenue—they need that high-touch experience. The rest can be managed just as effectively with a more scaled, tech-driven approach.

Key Roles and When to Hire Them

Hiring the right people at the right time is the difference between controlled growth and utter chaos. Your first few CS hires will wear a lot of hats, but specialization is inevitable. Here’s how to think about it.

1. Onboarding Specialist

- •What they do: Owns the make-or-break first 30-90 days of the customer journey. Their entire focus is on smooth implementation and getting customers to that "aha!" moment fast.

- •When to hire: The minute you see your CSMs spending more than 30% of their time on initial setup and training. This role is about protecting your CSMs' time for strategic, proactive work.

2. Customer Success Manager (CSM)

- •What they do: This is your core relationship owner. They are responsible for driving adoption, monitoring health scores, spotting expansion opportunities, and acting as the customer's trusted advisor.

- •When to hire: This is almost always your first CS hire, ideally before you even hit €1M ARR. A good rule of thumb is that one CSM can manage a book of business between €1M-€2M, depending on complexity.

3. Renewal Manager

- •What they do: This is a commercially focused role laser-focused on managing the renewal process. They handle all the contract negotiations and paperwork, freeing up CSMs to stay focused on delivering value.

- •When to hire: When renewals start becoming an administrative burden for your CSMs, pulling them away from their core responsibilities. This tipping point often happens as you approach the €8-10M ARR mark and the volume of renewals really picks up.

Structuring your team this way creates clean, seamless handoffs from Sales to Onboarding to the long-term CSM relationship. It’s how you build a customer journey that’s engineered for retention and growth from day one.

The Customer Success Metrics That Actually Matter

It's time to stop tracking vanity metrics. Your CEO and board don’t care how many calls your CSMs made last quarter. They care about how those activities translate directly into predictable, profitable revenue.

If you’re still leading conversations with Customer Satisfaction (CSAT) scores, you're focused on the wrong thing. CSAT is a lagging indicator—it tells you how a customer felt in the past, not what they’re going to do in the future. The real story of your business's health is told by the numbers that connect Customer Success directly to the balance sheet. This is how you shift the perception of CS from a "soft" cost center to a critical driver of your company's valuation.

Moving Beyond Churn to Revenue Retention

The most common mistake is an obsession with logo churn—the simple count of customers you lost. It’s a piece of the puzzle, but it completely misses the financial impact.

Imagine two customers churn. One was paying you €500/month, and the other was paying €25,000/month. On paper, your logo churn is "two," but the business impact is wildly different. You don't have the same problem; you have two very different problems.

That’s why mature RevOps and CS functions are laser-focused on revenue retention metrics. They tell you not just if you're keeping customers, but exactly how much money you're keeping—and growing—from that base.

1. Gross Revenue Retention (GRR)

GRR is the purest measure of your product's stickiness. It calculates your ability to hold onto the revenue you already have from your existing customers, excluding any new money from upsells or expansion. It's all about plugging the leaks in your revenue bucket.

- •Formula:

(Starting MRR - Churned MRR - Downgrade MRR) / Starting MRR - •What it tells you: "Are we keeping the money we already have?"

- •B2B SaaS Benchmark: A solid GRR is typically above 90%. According to research from firms like ChartMogul, companies selling to the enterprise should aim for closer to 95%.

A low GRR is a five-alarm fire. It’s a clear signal that customers aren't seeing the value they expected, your product has critical gaps, or your onboarding process is failing to deliver on its promise.

2. Net Revenue Retention (NRR)

NRR is the metric that gets investors excited. It takes your GRR and then adds back all the expansion revenue you've generated from upsells, cross-sells, and even price increases. When your NRR is over 100%, it means your business can grow even if you don't acquire a single new customer.

- •Formula:

(Starting MRR + Expansion MRR - Churned MRR - Downgrade MRR) / Starting MRR - •What it tells you: "Is our existing customer base a growth engine?"

- •B2B SaaS Benchmark: Top-tier SaaS companies consistently hit NRR rates of 120% or higher. According to SaaStr, an NRR of 130% is considered elite.

Think of it this way—your sales team fills the bucket with new revenue. Your Customer Success team is responsible for plugging the leaks (GRR) and making the water level rise all on its own (NRR).

Connecting Activities to Lifetime Value

Finally, you need a metric that ties everything together for the long haul. Customer Lifetime Value (LTV) shows the total revenue you can expect from a single customer throughout their entire relationship with you.

A high LTV is the direct result of a world-class customer success function. It’s the proof that a well-managed customer who achieves their desired outcomes will stay longer, buy more, and become a vocal advocate for your brand. Proactive CS activities—like Executive Business Reviews (EBRs) and consistent value-add engagement—are how you directly influence and increase LTV.

To keep a finger on the pulse of satisfaction, which is a key driver of LTV, a dedicated customer satisfaction calculator can be a great tool for getting quick, actionable insights.

By building a simple dashboard focused on GRR, NRR, and LTV, you completely change the narrative. You're no longer just reporting on customer happiness; you're presenting a clear, data-backed case for how your Customer Success function generates and protects the most valuable asset your company has: predictable, recurring revenue.

Integrating Customer Success Into Revenue Operations

Customer Success can't operate on an island. When it’s siloed, you get a disjointed customer journey riddled with friction and revenue leaks—a classic symptom of a scaling company that’s outgrown its early-stage playbook. This is exactly where Revenue Operations steps in to build the essential bridges connecting your CS team to Sales and Marketing.

Without RevOps, the handoff from Sales to CS is often a disaster. Sales reps, chasing quota, hastily close a deal and toss the new account "over the wall." The CSM is left with a new customer, sparse CRM data, and zero context on their actual goals. The result? A botched onboarding that starts the relationship on the wrong foot and dramatically increases the odds of early churn.

RevOps is the function that transforms this chaotic handoff into a structured, data-driven workflow, protecting the revenue you just fought so hard to win.

Building the GTM Bridges

A truly integrated go-to-market strategy means CS insights don't just stay with the CS team. They become a vital intelligence source for the entire revenue engine. RevOps is the architect of these data flows, ensuring what you learn post-sale actively informs your pre-sale strategy.

This integration is becoming non-negotiable as companies pour money into specialized tools. In the Middle East and Africa (MEA) region alone, the customer success platforms market hit USD 152.6 million and is on track to explode to USD 512.3 million by 2030. This growth is fueled by B2B SaaS and fintech companies desperate to plug revenue leaks with better engagement data. You can dig deeper into this trend in Grand View Research's full report.

But buying a platform isn't enough; you need an operational framework. Here are the core workflows RevOps must build:

- •The Sales-to-CS Handoff: This is the most critical junction. RevOps defines the mandatory data fields in your CRM that must be completed before an account can be passed to CS. Think key business objectives, primary stakeholders, and any specific commitments made during the sales cycle. No more guessing games.

- •Expansion Opportunity Triggers: RevOps can build automated alerts based on product usage. When a customer hits a specific usage threshold or starts exploring features tied to a higher-tier plan, an alert is automatically fired off to the CSM and the sales team. This turns product data into proactive upsell opportunities.

- •Customer Health Feedback Loops: Is a certain feature consistently tanking health scores? Are customers from a specific marketing campaign churning at a higher rate? RevOps ensures this intelligence is fed back to Product and Marketing, allowing them to make smarter, data-backed decisions.

From Silos to a Unified Revenue Engine

This unified approach creates a powerful, self-improving system. When CS, Sales, and Marketing all operate from the same source of truth, you eliminate guesswork and replace it with data.

A unified GTM motion isn't a buzzword; it's a machine. Customer health data stops being a passive metric and becomes an active driver for everything from lead scoring and sales forecasting to product roadmaps and marketing campaigns.

For instance, if customer health data shows that users who complete onboarding in the first seven days have a 25% higher LTV, that isn't just a CS metric. It’s a powerful insight for your entire go-to-market team. RevOps operationalizes this by building systems that push every team toward that goal. This focus on connecting the dots is the core of true revenue alignment.

The outcome is a GTM motion where every team understands its direct impact on the customer lifecycle and, ultimately, on revenue. Customer Success becomes a proactive, data-rich partner in growth—not just the team that cleans up messes after a deal closes.

Your Playbook for Customer Retention and Expansion

Theory is one thing, but results are what matter. To turn your Customer Success function into a revenue-generating machine, you have to move from abstract concepts to concrete, actionable plays. This section is your step-by-step guide to building and running the core CS strategies that directly hit your bottom line.

You need a playbook—a set of defined, repeatable actions your team can execute to drive predictable outcomes. We’ll focus on three critical areas: nailing the onboarding, proactive engagement that prevents churn, and a rapid-response plan for at-risk accounts. Each play comes with clear metrics, like 'Time to First Value,' so you can measure your impact and see a real lift in retention within a single quarter.

Play 1: The 30-60-90 Day Onboarding Plan

The first 90 days with a new customer can make or break the entire relationship. A great onboarding isn't just about showing users where to click; it's about proving your value proposition and laying the groundwork for a long-term partnership. Get this wrong, and you’re fighting an uphill battle against churn from day one.

The goal here is simple: guide the customer from initial setup to their first meaningful win as fast as possible.

Days 1-30: Get the Foundation Right

- •Action: Host a kick-off call with the key stakeholders identified during the sales handoff. The single most important task is to define and document their primary business objective.

- •Focus: Technical setup, user invites, and initial training on the features that matter most to their goal.

- •Success Metric: Time to First Value (TTFV). How quickly does the customer get that first "aha!" moment? Aim for under 14 days.

Days 31-60: Drive Adoption and Engagement

- •Action: Check in on their progress toward the initial goals and look at user adoption rates. You need to identify your power users and, just as importantly, those who are lagging behind.

- •Focus: Introduce secondary features that directly support their objectives. Share relevant best practices and customer stories that mirror their own use case.

- •Success Metric: Product Adoption Rate. What percentage of key features are they actually using? Your target should be 75% adoption of core functionalities.

Days 61-90: Solidify Value and Plan Ahead

- •Action: Conduct the first Executive Business Review (EBR). Come prepared with a report showing concrete progress against their original objectives.

- •Focus: This is all about reinforcing ROI and starting the conversation about their next set of strategic goals. It’s your first real opening to explore expansion.

- •Success Metric: Customer Health Score. Is their score trending in the right direction? A healthy, well-onboarded customer should have a score of 80+.

Play 2: Proactive Engagement with EBRs

Executive Business Reviews (EBRs) are your single most powerful tool for proactive engagement. When done right, they are not boring status updates. They are strategic consulting sessions that reinforce your value, uncover hidden risks, and identify growth opportunities before they become obvious.

An EBR is your chance to elevate the conversation from day-to-day product usage to long-term business impact. Your goal is to prove you are a strategic partner, not just another vendor on their expense report.

A huge part of retaining customers is building strong relationships through clear communication. To really nail this and boost retention, it pays to adopt robust client communication best practices.

Play 3: The At-Risk Intervention Checklist

Even with the best strategy, some customers will start to drift. The key is to spot the warning signs early and have a documented plan to win them back before it's too late. This requires a systematic approach, not a last-minute panic when the renewal notice goes out.

Early Warning Signs (Set up automated triggers for these):

- •A 20% drop in weekly active users.

- •Your key stakeholder or champion leaves the company.

- •A sudden spike in support tickets or a string of negative feedback.

- •No logins from key decision-makers for over 30 days.

This is where a clean GTM process becomes your first line of defense. A smooth, data-driven handoff from Sales through RevOps to Customer Success is fundamental to preventing these issues from ever cropping up.

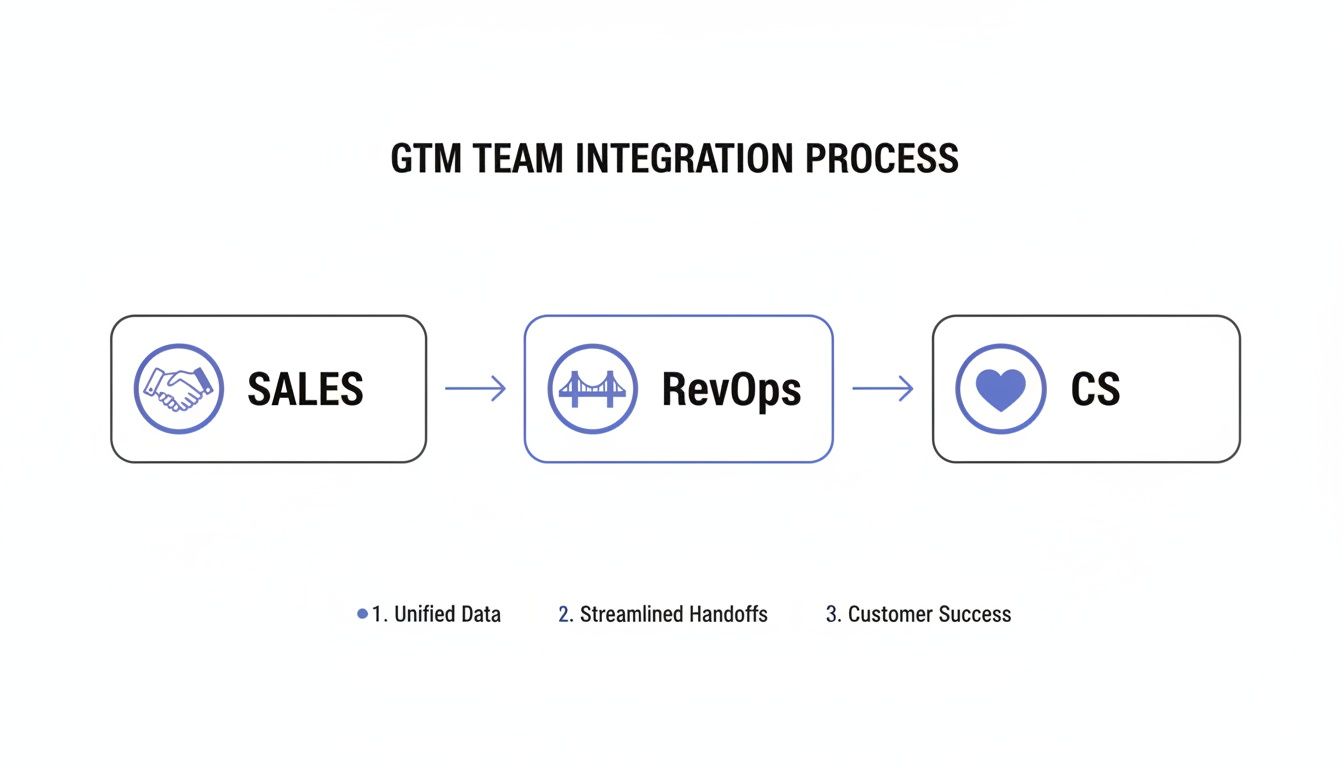

A GTM team integration process flowchart showing Sales, RevOps, and CS, highlighting unified data and streamlined handoffs for customer success.

The flowchart shows how RevOps should act as the central hub, making sure the critical context and goals captured by Sales are seamlessly passed to CS. This is what enables a successful onboarding and a healthy long-term relationship.

These plays provide a structured framework not just for driving retention, but for creating genuine expansion opportunities. They are essential building blocks of a robust land-and-expand strategy, turning your initial sale into a growing, predictable source of recurring revenue.

Common Customer Success Questions

As you start to scale, the tough questions about Customer Success will inevitably land on your desk. The answers you come up with now will directly shape your ability to keep customers, drive expansion, and build a predictable revenue machine. This is where the rubber meets the road.

Let's cut through the noise and tackle the most common debates that founders and RevOps leaders wrestle with. Getting these fundamentals right is the difference between building a CS team that just fights fires and one that becomes a strategic partner in your growth.

When Is The Right Time to Hire My First CSM?

The answer is almost always earlier than you think. The ideal window is when you have around 15-20 customers or are getting close to your first €1M in ARR.

Sure, founders can—and should—handle the first wave of customer relationships. But that hands-on approach simply doesn’t scale. Wait too long, and you'll find yourself buried in preventable "customer debt," scrambling to fix problems that should never have happened.

Hiring your first Customer Success Manager isn't a cost; it’s a strategic investment in your future. This person won’t just be managing relationships. They’ll be building the foundational processes that let you scale without breaking everything.

Their first 90 days should look something like this:

- •Developing a standardized onboarding checklist.

- •Creating the first draft of a customer health score.

- •Documenting common customer goals and popular use cases.

If you delay this hire, you'll be forced to play catch-up when churn is already a visible, painful problem—and that’s a far more expensive mess to clean up. A single CSM can typically manage a book of business between €1M-€2M, so getting them in early ensures you have the capacity in place before you’re drowning.

How Can We Prove The ROI of Customer Success?

To prove the ROI of your Customer Success team, you have to speak the language of the boardroom: revenue. Forget about vanity metrics like calls made or emails sent. Focus entirely on the financial impact that shows how CS directly props up the company's valuation.

The single most powerful metric here is Net Revenue Retention (NRR). It’s clean, simple, and shows exactly how your CS efforts are plugging revenue leaks (churn) while actively driving new growth (expansion).

Frame the ROI with a simple, powerful narrative: "Our Customer Success team cost €250k last year. In that same period, they saved an estimated €750k in churn and generated €500k in expansion revenue from their accounts. This delivered a clear 5x return on our investment."

Use cohort analysis to make it tangible. Show how customers who went through a structured onboarding process have a 15% higher retention rate than those who didn't. Connect specific CS plays—like conducting quarterly Executive Business Reviews (EBRs)—to higher product adoption and upsell rates. This is how you transform the conversation from CS being a "nice-to-have" expense to a quantifiable, profit-generating engine.

What Is The Single Biggest Mistake in Customer Success?

The most common—and damaging—mistake is treating Customer Success as a reactive, glorified support function. When this happens, your CSMs get buried in support tickets, putting out fires all day with zero time left for the strategic, proactive work that actually stops churn and drives growth. It's a fast track to CSM burnout and high customer turnover.

A great CS function has to be proactive. It must be deeply woven into your Revenue Operations framework, working hand-in-hand with Sales, Marketing, and Product.

To sidestep this trap, you need to establish clear rules of engagement from day one:

- •Separate the roles: Define what a support ticket is versus a success issue. Support handles break-fix problems ("this button is broken"). Success handles strategic guidance and goal achievement ("how can we use this feature to improve our workflow?").

- •Empower your CSMs: Give them the keys to the kingdom—product usage data, CRM history, and the health scores they need to see trouble coming and act on it.

- •Define clear handoffs: The sales-to-CS handoff needs to be seamless. The CSM should walk into the relationship already knowing the customer's goals, pain points, and expectations.

When CSMs are freed from the support queue, they can finally focus on high-value activities like driving adoption, spotting expansion opportunities, and building real strategic relationships.

Should Customer Success Own Renewals And Upsells?

This is a classic debate, and honestly, the answer depends on your business model. But for most scaling B2B SaaS companies, a hybrid approach usually offers the best of both worlds. It perfectly balances the CSM's role as a trusted advisor with the commercial need to hit revenue targets.

Here’s how it works: the CSM is responsible for the entire health and value journey of the customer. They own the relationship, drive adoption, and are tasked with identifying and qualifying expansion opportunities. They manage the renewal process from a relationship standpoint, ensuring the customer sees clear value and fully intends to stick around.

But when it's time to talk money, a dedicated Account Manager or a sales rep steps in to handle the final commercial negotiations and get the contract signed.

This structure allows your CSMs to maintain their position as trusted advisors focused purely on the customer's success—which is absolutely critical for building long-term trust. At the same time, it incentivizes them to spot growth opportunities, creating a smoother and more natural experience for the customer. It completely avoids that awkward moment where a CSM tries to be a supportive guide one day and a tough negotiator the next, a dynamic that can easily shatter the trust they’ve worked so hard to build.

Ready to build a revenue engine where Sales, Marketing, and Customer Success work in perfect alignment? Altior & Co.'s 6-Week Revenue Growth Sprint is designed for B2B SaaS and fintech leaders who need to plug revenue leaks and build a scalable foundation for growth. Learn how we can help you turn data into predictable revenue.