Build a scalable revenue architecture to fix leaks and accelerate growth. Our guide covers data models, CRM hygiene, and implementation for B2B SaaS leaders.

Let's be honest. When you think about generating more revenue, your mind probably jumps to hiring more salespeople or launching a new marketing campaign. But what if the real problem isn't your strategy, but the plumbing connecting everything together?

That plumbing is your revenue architecture. It’s the underlying system of processes, data, and technology that dictates how your business actually makes money. It's the blueprint for your entire go-to-market motion, defining everything from how a lead gets captured and routed to how sales hands off to customer success and handles a renewal.

When it's designed well, it creates predictable growth. When it's broken—and as a Forrester study notes, 90% of a B2B company's data is incomplete, inaccurate, or duplicative—it silently bleeds cash.

Your Revenue Architecture Is Silently Leaking Money

A clear funnel with coins spilling out, next to a laptop and a 'HIDDEN REVENUE LEAK' sign.

Most B2B SaaS and fintech companies don’t have a strategy problem; they have an architecture problem. You can have a killer product and a team of A-player reps, but if the systems connecting them are a tangled mess, you’re operating with an invisible handbrake on.

This isn’t just some abstract RevOps theory. It’s about the very real, very expensive gap between what you think is happening in your funnel and what your CRM data actually proves.

Slow lead response times, messy data, and clumsy handoffs between teams aren't just minor annoyances. They are symptoms of a flawed revenue architecture, a foundational weakness that puts a hard ceiling on how fast you can scale.

The Perception Gap in Revenue Operations

One of the most common—and costly—issues we see is the disconnect between what leaders believe is happening and what’s actually happening on the ground.

A sales VP might report to the board with total confidence that their team follows up with 85% of all marketing-qualified leads (MQLs) within 24 hours. But when you pull the CRM data? The truth is closer to 30%, with some of your highest-value leads going completely cold.

This isn't about blaming individuals. It’s about a system that lacks the structure to ensure the most critical actions happen, every single time. The consequences are direct and severe:

- •Lost Opportunities: High-intent leads get ignored, torpedoing your marketing ROI and practically handing deals to more organized competitors.

- •Inflated Sales Cycles: Reps waste precious time trying to re-qualify stale leads or hunting for information, which stretches out deal timelines.

- •Inaccurate Forecasting: When you can't trust your pipeline data, your revenue forecasts become a guessing game, making strategic planning nearly impossible.

"Show me the incentives, and I’ll show you the outcome." This quote from a discussion on The B2B Playbook is spot on. If your systems don't align incentives with the right processes, teams will naturally drift apart, each optimizing for their own siloed goals instead of overall revenue health.

Why Your Current System Is the Real Bottleneck

It’s tempting to chase quick fixes—a new sales script, another webinar, a different automation tool. But these are just band-aids on a cracked foundation. Without a solid revenue architecture, you’re practically designing a system where valuable information gets lost at every handoff. You can learn more about how these cracks lead to huge financial losses by understanding the signs of revenue leakage.

The problem isn't that your team isn't working hard enough. The problem is the structure they're working within makes alignment difficult and inefficiency the default setting.

A robust revenue architecture isn’t a ‘nice-to-have’ luxury for big companies. It's the essential operating system for predictable, scalable growth. It's what transforms your GTM engine from a collection of disconnected parts into a cohesive, data-driven machine.

The Five Pillars of a Scalable Revenue Architecture

Four white pillars on a blue block labeled 'REVENUE PILLARS', with a woman working on a tablet.

A powerful revenue architecture isn't a one-off project; it’s a living system built on five critical pillars. Moving from abstract theory to a practical blueprint means getting intimately familiar with each component.

When these pillars are strong and interconnected, they create a predictable engine for growth. But when one is weak, the entire structure becomes unstable, and you start seeing the cracks in your revenue performance. Let’s break down the five pillars that form the foundation of a system that actually scales.

1. The Go-to-Market Data Model

Think of this as the architectural blueprint of your entire revenue process, hardwired directly into your CRM. A well-designed data model isn't just about adding a few custom fields; it’s about structuring your system to perfectly mirror your customer's journey. It dictates what information is crucial at each stage and ensures data flows logically from lead to renewal.

If your sales process has five distinct stages, your CRM's opportunity object must reflect that with crystal-clear entry and exit criteria for each one. Anything less is a compromise. You’re forcing your team to work against the system, which leads to messy data and forecasts that are pure guesswork. This foundational work is a core part of effective revenue operations, ensuring your tech supports your strategy, not the other way around.

2. System and Process Integration

Silos are where revenue goes to die. This pillar is all about creating seamless, automated handoffs between Marketing, Sales, and Customer Success. It’s making sure that when a lead becomes marketing-qualified, it doesn't get tossed over the wall to sales. It gets transferred with full context, engagement history, and a clear next step.

Proper integration means data from your marketing automation platform automatically enriches the lead record in your CRM. It means when a deal closes, a Customer Success account is instantly created with all the necessary details from the sales cycle. This eliminates mind-numbing manual data entry, cuts down on human error, and creates a smooth customer experience from the very first touchpoint.

A Gartner study highlights that companies with tightly aligned sales and marketing operations achieve 24% faster three-year revenue growth and 27% faster three-year profit growth. This isn't a coincidence; it's the direct result of a well-integrated architecture.

3. Lead and Opportunity Routing

In B2B sales, speed is everything. How quickly you respond to an inbound lead can be the single biggest factor in whether you win or lose the deal. This pillar is all about implementing automated, intelligent routing rules that get the right leads to the right reps, instantly.

This is much more than a simple round-robin assignment. A robust routing system considers multiple variables:

- •Territory: Assigning leads based on geographical region.

- •Company Size: Routing enterprise leads to senior account executives.

- •Product Interest: Directing inquiries about a specific feature to a product specialist.

For instance, a fintech scale-up we worked with implemented skills-based routing logic. Leads interested in their complex derivatives product were automatically sent to reps with specialized training. The result? They cut their average sales cycle for that product line by a full 22% in just two months. Before you even begin building your scalable revenue architecture, creating a winning franchise development plan is the first crucial step to attracting top partners.

4. Measurement and Attribution

You can't fix what you can't see. This pillar is about building dashboards and reports that serve as the single source of truth for your entire go-to-market funnel. It’s about getting past vanity metrics and focusing on the numbers that actually drive the business forward.

Effective measurement provides clear answers to the questions that keep you up at night:

- •Which marketing channels are generating the most qualified pipeline?

- •What is our lead-to-opportunity conversion rate by segment?

- •How long does a deal really sit in Stage 2 before moving to Stage 3?

Proper attribution is the key that unlocks the whole thing. It connects marketing spend directly to closed-won revenue, allowing you to double down on what’s working and cut what isn’t. Without it, your budget allocation is just a series of educated guesses.

5. Governance and Data Hygiene

Finally, a strong revenue architecture requires constant maintenance. This pillar establishes the rules and processes needed to keep your data clean, accurate, and trustworthy. Without good governance, even the most perfectly designed system will decay into a mess over time.

This involves setting up data validation rules, defining clear ownership for key fields, and running regular cleanup processes to merge duplicates and standardize information. It’s not the sexiest part of RevOps, but it’s arguably the most important. Bad data leads to bad decisions, erodes trust in the system, and makes every other pillar weaker.

How Healthy Are Your Revenue Pillars?

Before you start building, you need to know where the cracks are. Use this quick checklist to run a diagnostic on your current setup. Be honest—the red flags are where your biggest opportunities for improvement lie.

Revenue Architecture Pillar Audit Checklist

| Pillar | Key Question to Ask | Red Flag (Sign of Weakness) | Green Flag (Sign of Strength) |

|---|---|---|---|

| Data Model | Does our CRM accurately reflect our real-world sales process? | Reps use spreadsheets to track their pipeline because the CRM is too clunky. | Opportunity stages have clear entry/exit criteria that are enforced system-wide. |

| Integration | Can data flow automatically between Marketing, Sales, and CS tools? | Sales has to manually log in to the marketing platform to see lead activity. | A new closed-won deal automatically triggers a CS onboarding workflow. |

| Routing | How long does it take for a new inbound lead to get assigned to a rep? | "I'll assign it out in the morning" is a common phrase. | Leads are assigned to the correct rep based on territory and specialty in under 5 minutes. |

| Measurement | Can we confidently attribute a closed deal back to its original marketing source? | Marketing and Sales report on different "revenue" numbers. | A single dashboard shows the entire funnel from first touch to closed-won. |

| Governance | Do we trust the data in our CRM enough to make strategic decisions with it? | Duplicate records are rampant, and key fields like "Industry" are free-text. | Data validation rules prevent reps from creating opportunities without key information. |

This self-audit won't solve all your problems, but it will give you a clear, prioritized list of where to focus your efforts first. A solid foundation across these five pillars is non-negotiable for building a revenue engine that doesn't just grow, but scales predictably.

How to Diagnose Gaps in Your Current System

Before you can build a scalable revenue architecture, you have to find the cracks in your current foundation. This isn’t about guesswork or gut feelings; it’s a forensic investigation into your go-to-market engine to find exactly where value is leaking out.

The whole point is to move beyond assumptions. We need to quantify the gap between what your team thinks is happening and what the data actually proves is happening. This diagnostic process, which mirrors our own proven approach, combines the hard numbers from your systems with the real-world experiences of your team.

Start with Quantitative Analysis in Your CRM

Your CRM holds the objective truth about your revenue process, but only if you know which reports to pull and what to look for. Don't try to boil the ocean. Instead, zero in on a few core metrics that reveal the health of your funnel from top to bottom.

These reports will expose the friction points that are silently killing your deals and stretching your sales cycles.

- •Lead Response Time: What's the average time it takes for a rep to actually do something with a new MQL? A slow response time is a massive, flashing red light. One HubSpot study found that firms contacting potential customers within an hour were nearly seven times as likely to have a meaningful conversation with a decision-maker.

- •Lead-to-Opportunity Conversion Rate: Of all the leads marketing generates, what percentage actually becomes a legitimate sales opportunity? Low rates here often scream poor lead qualification, a major disconnect between marketing's message and sales' reality, or painfully slow follow-up.

- •Sales Cycle Length by Segment: You need to measure the average time from opportunity creation to closed-won, but don’t stop there. Segment this data by deal size, industry, or lead source. You might discover that enterprise deals close 30% faster when they come from partner channels—a critical insight for where you put your resources.

- •Stage-by-Stage Conversion: Look at the drop-off rate between each stage in your sales process. Is there a huge cliff between "Discovery Call" and "Proposal"? That's a classic sign your reps are pushing unqualified prospects too far, too fast.

Running these reports gives you a data-driven starting point. It replaces vague feelings like, "I think our follow-up is slow," with cold, hard facts like, "Our average lead response time is 72 hours."

Uncover Process Friction with Qualitative Interviews

Data tells you what is happening. Talking to your team tells you why. The next step is to sit down with key players in your sales and marketing teams to understand their day-to-day reality and find the process gaps that never show up on a dashboard.

Don't ask broad, useless questions like, "What are your biggest challenges?" Get specific. Ask about the handoffs between systems and people. The goal is to compare the process as it's described to you with the process as it's actually reflected in the data.

"Show me the incentives, and I’ll show you the outcome." This idea is crucial. Your team’s behavior is a rational response to the system you’ve built. If reps aren’t updating the CRM, it’s not because they’re lazy; it’s because the system hasn’t made it essential or rewarding for them to do so.

Here are a few targeted questions to get you started:

- •"Walk me through the exact process for handing off a new MQL from marketing to sales. Who gets it? When? What information is included?"

- •"What are the specific criteria that must be met for an opportunity to move from Stage 2 to Stage 3?"

- •"If you get a lead that isn't a good fit right now, what is the actual process for nurturing it for the future?"

The answers will be incredibly revealing. You’ll often find that five different sales reps describe five different processes for the exact same task. This lack of standardization is a classic symptom of a broken revenue architecture.

Prioritize Based on Revenue Impact

By combining the quantitative data with the qualitative feedback, you can build a prioritized list of issues to tackle. For a more structured approach, you can grab our SaaS Funnel Audit Checklist, which gives you a comprehensive framework for organizing your findings.

The final, critical step is to map each problem you’ve identified to its potential revenue impact. This is how you turn your diagnostic findings into a compelling business case for change that your CFO can't ignore.

Instead of saying, "We need to improve lead routing," you can say, "Our data shows a 48-hour delay in assigning 30% of our inbound leads. Based on our average deal size and conversion rates, fixing this single issue could unlock an additional €250k in pipeline this quarter."

This diagnostic phase is the most critical step in the entire process. It ensures you’re not just rearranging the deck chairs but are instead making targeted, data-backed interventions that will have a measurable impact on your company's growth.

Your Six-Week Implementation Blueprint

A proper diagnosis gives you a clear map of the problems. Now, it's time to execute. Rebuilding your revenue architecture doesn’t have to be a daunting, year-long project that never seems to end. We run a structured six-week sprint that transforms your GTM engine from a source of friction into a predictable growth machine.

This isn't a high-level strategy document; it's a practical, week-by-week blueprint for getting it done. The goal is to deliver tangible, measurable progress in a short timeframe, building momentum and proving ROI to stakeholders every step of the way.

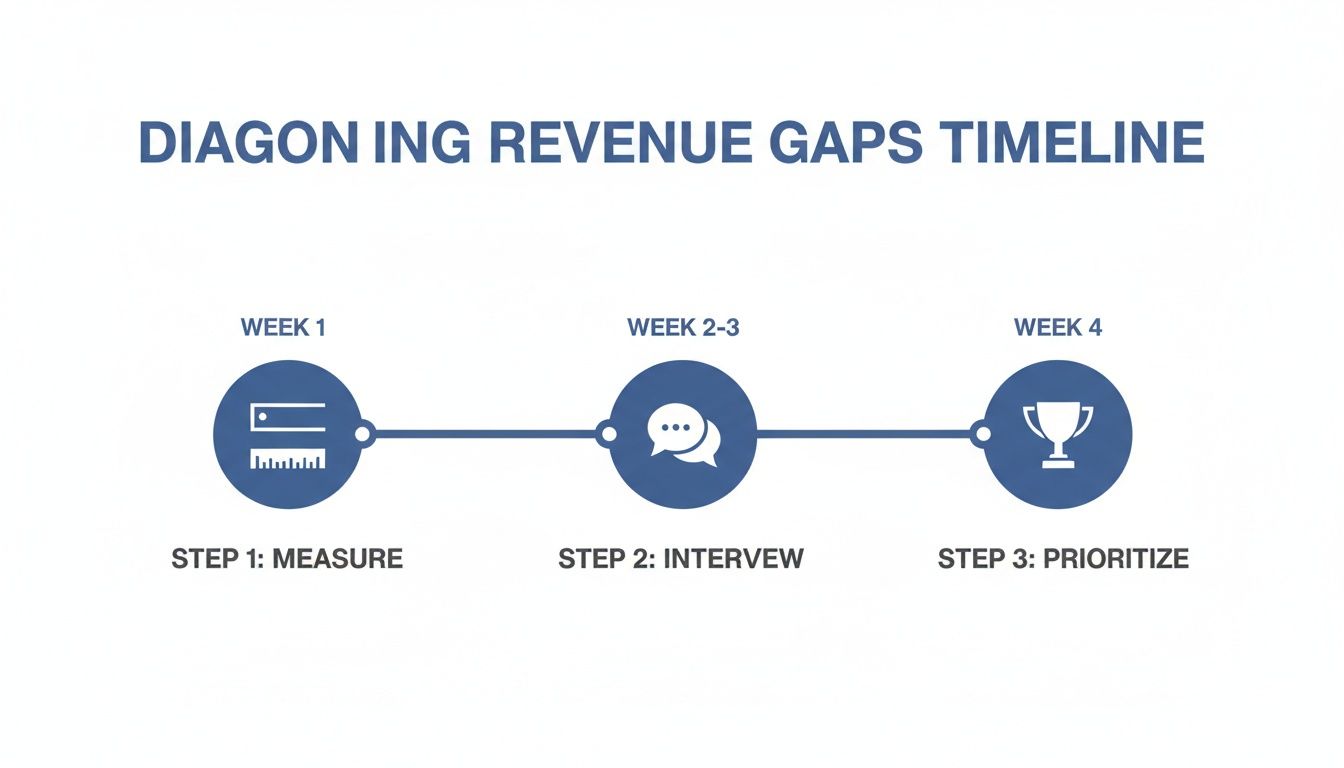

The first step in diagnosing any revenue gap is to measure, interview, and then prioritize your actions.

Timeline outlining three steps to diagnose revenue gaps: measure, interview, and prioritize over four weeks.

This visual timeline underscores a critical truth: effective action begins with a clear understanding of the data, followed by gathering human context, before you commit resources to the highest-impact fixes.

To bring this to life, we've broken down the entire implementation process into a focused 6-week plan. This table outlines the core focus, key actions, and the single most important metric for each two-week sprint. It's designed to keep your team aligned and moving fast.

The 6-Week Revenue Architecture Implementation Plan

| Sprint Phase (Weeks) | Core Focus | Key Actions | Success Metric |

|---|---|---|---|

| Weeks 1-2 | Foundational Data & CRM Cleanup | Finalize data model, execute data cleanup (merge duplicates, standardize fields), and establish data governance rules in the CRM. | Achieve 95% data hygiene for all net-new leads and opportunities. |

| Weeks 3-4 | Process Automation & Systematization | Implement lead routing rules, automate task creation for reps based on triggers, and configure SLA alerts for managers. | Reduce manual data entry and task assignment time by 50%. |

| Weeks 5-6 | Measurement & Team Enablement | Build core KPI dashboards, conduct hands-on team training on new workflows, and create a documented playbook. | Reduce average lead response time to under 4 hours. |

This plan isn't just a to-do list; it's a roadmap for building a scalable revenue engine. Below, we'll dive into what each phase looks like in practice.

Weeks 1-2: Foundation and Data Cleanup

You can't build a skyscraper on a swamp. The first two weeks are entirely dedicated to stabilizing the foundation: your data model and CRM hygiene. Everything else you do will fail if this part is rushed or ignored.

The primary focus is transforming your CRM from a messy digital filing cabinet into the single source of truth for your entire GTM motion. This means standardizing fields, archiving obsolete data, and ensuring your CRM objects accurately mirror your customer journey.

- •Finalize the Data Model: Define and lock in the required fields, picklist values, and stage definitions for Leads, Accounts, Contacts, and Opportunities. No more "maybe" fields.

- •Execute a Data Cleanup: Run a full audit to merge duplicate records, standardize naming conventions (e.g., "United Kingdom" vs. "UK"), and enrich key accounts with missing firmographic data.

- •Establish Governance Rules: Implement data validation rules in your CRM to prevent bad data from entering the system in the first place. For example, make 'Industry' a mandatory, standardized field for all new accounts.

Success Metric for this Phase: Achieve 95% data hygiene for all net-new leads and opportunities by the end of Week 2. This means every new record has all required fields populated with clean, standardized data.

Weeks 3-4: Process Automation and Routing

With a clean foundation in place, you can start building the machinery that drives efficiency and speed. These two weeks are focused on automating the core processes that connect your GTM teams, eliminating manual work and enforcing your operational rules.

This is where you build the automated handoffs and lead routing logic that ensure opportunities never fall through the cracks. It's about turning your defined processes into system-enforced workflows. A B2B SaaS firm we partnered with saw a 30% improvement in pipeline velocity simply by automating task creation for sales reps after a prospect downloads a key piece of content.

- •Implement Lead Routing Rules: Build and deploy automated routing logic. This could be a simple round-robin for SMB leads or a complex, territory-based matrix for enterprise accounts.

- •Automate Task Creation: Set up workflows that automatically create follow-up tasks for reps based on specific triggers (e.g., an MQL is assigned, a deal enters a new stage).

- •Configure SLA Alerts: Build notifications that alert managers when a lead hasn't been actioned within the agreed-upon timeframe (e.g., 4 hours).

Weeks 5-6: Measurement and Enablement

A new system is useless if no one knows how to use it or how to measure its impact. The final two weeks are about building your core KPI dashboards and training the GTM team on the new, streamlined processes.

This phase is critical for driving adoption and proving the project's success. You need to provide the team with both the tools and the knowledge to operate effectively within the new architecture. Accurate measurement is also key to improving your financial models. For a deeper look into this, check out our guide on the fundamentals of revenue forecasting.

- •Build Core KPI Dashboards: Create real-time dashboards in your CRM to track lead response time, conversion rates by stage, sales cycle length, and pipeline velocity.

- •Conduct Team Training: Run hands-on enablement sessions with the sales and marketing teams to walk them through the new workflows, from lead handoff to opportunity management.

- •Document Everything: Create a simple, accessible playbook that documents the new processes, field definitions, and SLAs.

Success Metric for this Phase: Reduce average lead response time to under 4 hours by the end of Week 6.

This six-week sprint is designed to be intense but manageable. It front-loads the foundational work and builds toward measurable outcomes, ensuring you can demonstrate a clear return on investment and build a revenue architecture that truly scales.

Measuring Success and Benchmarking Performance

So, you’ve put in the hard work. You’ve diagnosed the issues, untangled the spaghetti, and rebuilt your revenue architecture from the ground up. Now for the most important question: how do you prove it's actually working?

The answer isn't about pulling vanity metrics for a feel-good dashboard. It’s about focusing on the handful of core performance indicators that directly prove ROI and show you're on the right track. A solid measurement framework doesn’t just track progress; it tells you where you stand against the competition. You have to know what “good” looks like for a company at your stage.

The Core Metrics That Actually Matter

Forget the surface-level numbers. To really understand the health of your revenue architecture, you need to go deeper. If you're just getting started, this comprehensive guide to revenue analytics is a great resource.

When it comes to your architecture, concentrate on these four indicators:

- •Pipeline Velocity: This is the ultimate health metric for your entire sales engine. It’s not just about how many deals you have, but how fast they’re moving and how much they're worth. The formula is simple:

(Number of Opportunities x Average Deal Value x Win Rate) / Sales Cycle Length. An uptick here is the clearest sign you’re making more money, faster. - •Sales Cycle Length: How long does it take to get a deal from opportunity to closed-won? A well-built revenue architecture systematically crushes friction points, which should directly translate to a shorter sales cycle. For B2B SaaS companies in the €8-10M ARR range, a cycle under 90 days is a solid benchmark to aim for.

- •Lead-to-Close Conversion Rate: This one measures the end-to-end effectiveness of your entire go-to-market motion. A low overall conversion rate is a massive red flag, pointing to serious leaks somewhere in your funnel—be it poor qualification, broken handoffs, or sloppy follow-up.

- •Customer Acquisition Cost (CAC): While not purely a RevOps metric, your architecture's efficiency has a huge impact on CAC. Smoother, faster processes mean less wasted time for your reps and less wasted marketing spend, which directly lowers the cost to bring on each new customer.

How Do You Stack Up? Benchmarking Against Your Peers

Knowing your own numbers is only half the battle. You absolutely need context. How do your metrics compare to other B2B SaaS companies at a similar growth stage?

Drawing on insights from industry leaders like SaaStr and ChartMogul, here are a couple of key benchmarks for companies hovering around the €8-10M ARR mark:

- •Trial-to-Paid Conversion Rate (for PLG): A healthy rate here is typically between 15-25%. If you’re dipping below 10%, that’s a strong signal your architecture has friction somewhere in the user onboarding or value-realization process.

- •MQL-to-SQL Conversion Rate: This is where you see if sales and marketing are truly aligned. Strong alignment should get you conversion rates of 10-20%. Anything lower screams of a mismatch in what defines a good lead or a broken handoff process.

"A great revenue architecture isn't just about internal efficiency; it's about building a system that predictably performs at or above industry standards. Benchmarks are the compass that tells you if your optimisations are truly moving the needle in the right direction."

Common Pitfalls and How to Avoid Them

Building a new revenue architecture is a high-stakes project. Even the most elegant blueprints can crumble during construction. I’ve seen it happen time and again: companies stumble over the same predictable hurdles, turning a strategic growth initiative into a costly, low-adoption mess.

Knowing what these pitfalls are before you start is the single best way to navigate the operational and political minefields that derail otherwise solid plans. It’s about having the discipline to build a scalable system, not just a collection of shiny new tools.

Over-Engineering Your Tech Stack

This is the classic, number-one mistake. A team gets excited about a new piece of software, convinced its cutting-edge features will magically fix their revenue problems. They buy and implement technology before they’ve clearly defined the process it’s supposed to support.

What you end up with is a more expensive, more sophisticated way to create chaos. You’re just automating a broken process.

For instance, a company might invest in a complex lead-scoring tool, layering on dozens of rules and attributes. But if they never got sales and marketing in a room to agree on what a truly qualified lead is in the first place, the tool just becomes a high-tech cannon for firing bad leads at the sales team, faster than ever before.

The Fix:

- •Process First, Tech Second: Get your stakeholders in front of a whiteboard. Map out your ideal lead management and opportunity workflow from start to finish before you even look at a software demo. Define your stages, your handoff criteria, and your SLAs.

- •Start Simple: Begin with a minimal viable tech stack. Get the core process working and build the right habits first. You can always layer on more advanced tools once the foundation is solid.

Failing to Secure Ongoing Executive Buy-in

Getting a thumbs-up from leadership at the kickoff meeting is the easy part. Keeping that support when the project gets messy and deadlines slip? That's the real challenge. A revenue architecture project isn't just a CRM update; it's a massive change management initiative.

Without sustained executive sponsorship, your project will be deprioritized the second a more "urgent" fire erupts. Reps will ignore new workflows, and other departments will push back on requests for their time. It will die a slow, quiet death.

One HubSpot study found that many CRM implementation failures boil down to low user adoption—a direct symptom of weak leadership reinforcement. If executives aren't using the new system in their own reporting and meetings, why should anyone else?

Neglecting Team Enablement and Training

You can build the most beautiful, efficient revenue engine in the world, but if your team doesn't know how to drive it—or even why they should bother—it’s going to sit in the garage collecting dust.

A single, two-hour launch training is never, ever enough. That’s not how people learn. Within a week, they’ll have forgotten most of it and reverted to their old, comfortable spreadsheets. Poor adoption is the silent killer of these projects.

The Fix:

- •Create "RevOps Champions": Find a few tech-savvy and well-respected people on the sales and marketing teams. Involve them in the design process from the start. Empower them to be your advocates and peer trainers. Their influence is worth more than any top-down mandate.

- •Bite-Sized, Ongoing Training: Ditch the overwhelming launch event. Instead, run short, focused training sessions on specific workflows. Think a 15-minute weekly session on "How to properly convert an MQL" or a quick Loom video on a new dashboard.

- •Document Everything: Build a simple, easy-to-find playbook. This should be the single source of truth for all your new processes, field definitions, and SLAs. When someone has a question, the answer is "check the playbook."

Common Questions About Revenue Architecture

Got questions? Good. It means you’re thinking about the right things. Here are the straight-up answers to the questions we hear most often from B2B SaaS and fintech founders knee-deep in scaling their go-to-market engine.

What Is Revenue Architecture, Really?

Forget the jargon. It’s the blueprint for how your company makes money.

It’s the underlying system—the combination of your data, your processes, and your tech stack—that dictates exactly how a lead moves from their first click to a signed contract and a successful renewal. A solid revenue architecture makes growth predictable and scalable. A broken one makes it feel like you're guessing every quarter.

Isn't This Just Another Word for RevOps?

Not exactly, and the distinction is critical.

Revenue Operations (RevOps) is the team and the day-to-day function that manages, maintains, and tunes the GTM engine. They’re the mechanics.

Revenue architecture is the design of that engine. It’s the foundational structure that RevOps is hired to run. You can have the best RevOps team in the world, but if the architecture is flawed, they’ll spend all their time patching holes instead of driving growth.

How Long Does It Actually Take to Implement?

For a focused scale-up, we see a foundational implementation sprint taking about six weeks.

Now, that doesn't mean everything will be perfect in six weeks. The goal is to move fast, fix the most critical breaks, and build a solid foundation you can iterate on. We're aiming for tangible progress—like slashing lead response times or finally trusting your CRM data—not a multi-quarter overhaul.

What's the Single Biggest Mistake You See Companies Make?

Easy. Buying expensive technology before defining the process it’s supposed to fix.

Too many leaders throw a new CRM or automation tool at a problem hoping for a silver bullet. Instead, they just end up automating a broken workflow, making the chaos happen faster and more efficiently. Always, always map your process on a whiteboard before you even think about booking a software demo.

Ready to stop patching a leaky GTM engine and start building one that scales predictably? By applying this framework, you can expect a 15-25% improvement in pipeline velocity within 6 weeks.

Learn how the 6-Week Revenue Growth Sprint can deliver a clear blueprint for your growth.