Unlock growth with our definitive guide on Sales & Marketing Alignment. Learn the proven frameworks B2B SaaS leaders use to fix revenue leaks and scale.

Sales and marketing alignment is the strategic glue that holds your go-to-market teams together, getting them to operate as a single, unified force. It’s about creating a shared system of communication, goals, and data to kill the friction that silently bleeds revenue.

Why Your Growth Has Stalled

A man in a suit works on a laptop at a wooden table, next to a 'GROWTH STALLED' sign.

Feel like your sales and marketing teams are rowing in opposite directions? You're not imagining it. That feeling is a measurable drain on your revenue.

When growth hits a wall, it’s almost never a single catastrophic failure. It’s the death-by-a-thousand-cuts from dozens of small, invisible friction points that kill momentum every single day. This isn’t some vague theory; it's the tangible pain you see in your pipeline. It’s the quality leads from marketing that go cold in a sales rep’s inbox. It’s the endless, circular debates over lead quality. It’s the anemic pipeline that never seems to reflect your marketing spend.

You’re left with a go-to-market engine that feels powerful on paper but is stuck in neutral.

The Perception Gap That Hides the Truth

One of the biggest blockers to fixing this is the chasm between what leadership thinks is happening and what the data proves is actually happening. Sales leaders often report that their teams follow key processes with 80% compliance. They trust the systems are working and the teams are executing as planned.

But when you dig into the raw CRM data, the truth is often closer to a shocking 25%.

That's not a typo. This gap explains why your forecasts feel like guesswork and why growth remains so unpredictable. The problem isn't a lack of effort; it's a profound lack of operational clarity.

"Gartner research found sales leaders that prioritise alignment with their marketing department are nearly three times more likely to exceed new customer acquisition targets than their peers who don’t seek out this alliance."

This drives home a critical point: achieving sales and marketing alignment isn't a "nice-to-have" cultural initiative. It is the single most important operational problem you can solve. It’s about building systems that reveal what's truly working—and what isn’t—so you can stop the endless debates and start executing.

Often, stalled growth traces back to a breakdown in data integrity. Exploring the common data and analytics challenges in digital marketing can shed light on the pitfalls that are silently sabotaging your alignment efforts and crippling business performance.

Before you can solve this, you need to understand the disconnect. Here’s a look at the common perception gaps we see in misaligned organizations.

The Misalignment Diagnostic: Perception vs. Reality

This table highlights the common disconnects between what leadership believes is happening and what the data actually shows in misaligned organizations.

| Area of Operation | Common Leadership Perception | Data-Backed Reality |

|---|---|---|

| Lead Follow-Up | "Our reps follow up on all MQLs within 24 hours." | "Only 40% of MQLs are actioned within 72 hours. Top-tier leads have a 2-day response time." |

| Content Usage | "Marketing creates great content that sales uses to close deals." | "Sales reps use marketing content for less than 15% of their deals and create their own materials." |

| Lead Handoff | "Our handoff process from Marketing to Sales is seamless." | "There is a 35% lead leakage rate between MQL and SAL stages due to no clear ownership." |

| ICP Targeting | "Both teams are targeting our Ideal Customer Profile." | "Marketing's ICP definition differs from the profiles Sales actually closes, leading to a 70% MQL-to-SQO mismatch." |

Seeing these gaps laid out in black and white is often the catalyst for real change. It moves the conversation from opinions to objective facts.

Diagnosing the Symptoms of Misalignment

Before you can prescribe a solution, you need an accurate diagnosis. Misalignment isn't a feeling; it manifests in specific, measurable ways across your revenue engine. Do any of these sound painfully familiar?

- •Inconsistent Lead Follow-Up: Marketing generates leads, but there’s no clear Service Level Agreement (SLA) dictating how quickly sales must act. Hot leads decay on the vine, and potential revenue evaporates.

- •Competing Definitions of Success: Marketing celebrates hitting their MQL targets, while sales misses its quota and blames lead quality. Both teams hit their individual goals, but the business fails.

- •A "Black Hole" Handoff: A lead gets passed from marketing to sales and seemingly disappears. There is zero visibility into what happened next, preventing marketing from ever refining campaigns based on real outcomes.

- •Wasted Content and Resources: Marketing creates decks and one-pagers they believe sales needs, but reps ignore them. Instead, they build their own one-off materials because the official assets just don't resonate with buyers.

These are not people problems; they are process and systems problems. Fixing them requires moving beyond "more meetings" and building a shared operational rhythm grounded in a single source of truth.

The Four Pillars of a Bulletproof Smarketing Framework

True sales and marketing alignment doesn’t come from team-building offsites or a sudden desire to “collaborate better.” It’s a system. It's an operational framework built on hard agreements and shared data. Without this structure, you’re just left with good intentions and the same old friction points.

Effective alignment, or "Smarketing," is built on four non-negotiable pillars. Getting these right is how you move from vague goals to concrete actions that actually drive revenue. Let’s get into what they are and how to build them.

Pillar 1: Shared Revenue Goals

Here’s the most common failure point I see: Marketing is measured on MQLs, and sales is measured on closed-won revenue. This single misalignment creates a fundamental disconnect. Marketing can crush its MQL target every single month, but the business can still miss its revenue goals, leaving sales pointing fingers at a flood of “low-quality leads.”

The fix is surprisingly simple, yet profoundly effective: tie both teams to the same North Star metric. Revenue.

This doesn't mean marketing throws its funnel metrics out the window. It just means that MQLs, SQLs, and pipeline generation are correctly viewed as leading indicators of the ultimate goal, not the goal itself.

- •Marketing's goal shifts: Instead of "generate 500 MQLs," the goal becomes "generate enough qualified pipeline to support the €2M quarterly revenue target."

- •Sales' perspective changes: They start seeing marketing as a true partner in revenue creation, responsible for sourcing a specific percentage of the company's bookings, not just a lead factory.

This one change forces an entirely different conversation. It stops being about volume and starts being about the revenue impact of every single marketing dollar spent.

Pillar 2: A Universal Lead Definition

The endless, soul-crushing debate over “bad leads” stops the second you create a universal, data-driven definition of what a qualified lead actually is. This can't be marketing's definition or sales' definition; it has to be a company definition that both teams build and sign off on.

And it has to be ruthlessly specific. Vague criteria like "showed interest" are totally useless. You need a combination of demographic, firmographic, and behavioral data.

A strong lead definition isn't just a document; it's code. It should be programmed directly into your marketing automation platform and CRM to ensure every lead is scored and categorized objectively, removing human bias from the initial qualification process.

Imagine a B2B SaaS company selling project management software. Their universal MQL definition might look like this:

- •Firmographic Fit: Company has 50-500 employees in the construction or engineering industry.

- •Demographic Fit: Lead's title is Project Manager, Head of Operations, or C-level.

- •Behavioral Signal: They attended a webinar on "Improving Project Profitability" AND viewed the pricing page twice in one week.

Any lead hitting these exact criteria is automatically flagged as an MQL. This clarity ends the subjective arguments and lets marketing focus on generating leads that meet the agreed-upon standard.

Pillar 3: A Seamless Lead Handoff Protocol

Once a lead is universally defined, the handoff from marketing to sales needs to be as clean as a baton pass in a relay race. Any fumbling here creates a black hole where perfectly good, qualified leads go to die. This is where a Service Level Agreement (SLA) becomes your best friend.

An SLA is just a documented agreement that outlines the specific rules of engagement. It answers two critical questions:

- •Marketing's Commitment: We will deliver X number of qualified MQLs per week that meet our universal definition.

- •Sales' Commitment: We will follow up with every single MQL within a specific timeframe (e.g., 2 hours) and stick to a defined follow-up cadence (e.g., 5 attempts over 10 days).

This simple document is transformative because it creates mutual accountability and makes performance measurable. You can now see exactly where the process is breaking. If sales isn't meeting the 2-hour SLA, you have a coaching and process problem, not a lead quality problem.

Pillar 4: A Single Source of Truth

The final pillar is the technological bedrock that holds everything else together: a Single Source of Truth (SSoT). For nearly every B2B SaaS company, this is your CRM (like HubSpot or Salesforce). It must be the undisputed, non-negotiable record for all customer and prospect interactions.

Alignment is impossible when data is scattered across marketing's platform, a sales rep's private spreadsheet, and a separate support tool. This fragmentation is a massive, and often invisible, barrier to growth.

In fact, this isn't a small problem. In the APAC region, while 72% of leaders know alignment boosts performance, a staggering 60% admit that fragmented prospect information is their number one blocker. This huge gap between belief and reality shows just how critical a unified data source is. You can read the full research on these alignment challenges to see how deep the issue runs.

Enforcing the CRM as your SSoT means:

- •All marketing campaigns are tracked back to contact and deal records in the CRM.

- •All sales activities—every call, email, and meeting—are logged in the CRM.

- •All reporting and dashboards for both teams pull directly from the CRM.

This ensures everyone is operating from the same dataset. The debate finally shifts from "whose numbers are right?" to "what are the numbers telling us, and what are we going to do about it?"

Your 30-Day Sprint to Unify Sales and Marketing

Frameworks and theory are a good starting point, but they don't generate revenue. Execution does. Moving from siloed teams to genuine sales and marketing alignment demands a focused, time-bound push to force change and build momentum. This isn’t a six-month strategic initiative; it's a 30-day sprint.

This week-by-week playbook is your no-fluff roadmap. It's designed to cut through the noise and zero in on the high-impact actions that will transform your revenue engine, moving you from guesswork to a system of predictable growth.

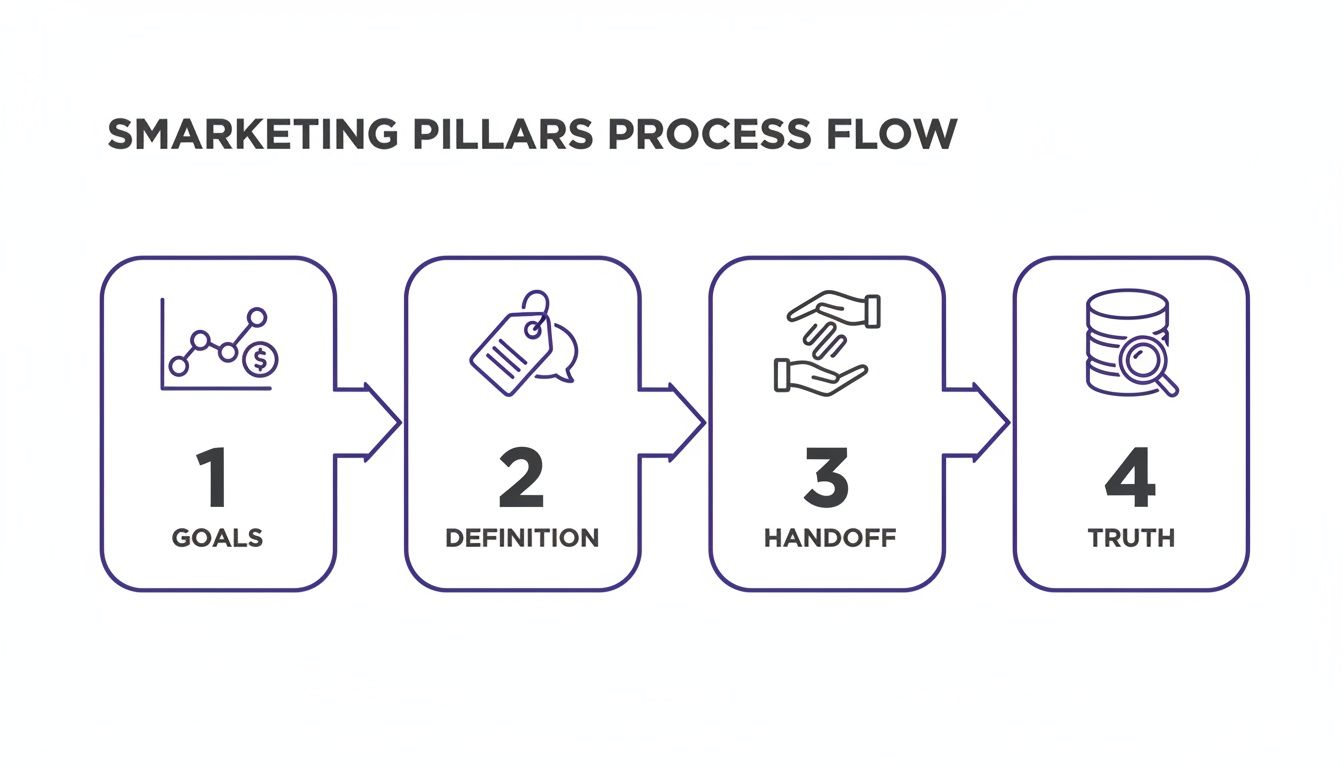

This process flow shows the core pillars we’ll be building throughout the sprint, starting with shared goals and ending with a single source of truth.

A Smarketing Pillars Process Flow diagram illustrating 4 steps: Goals, Definition, Handoff, Truth.

Think of this as the logical progression from a strategic handshake on goals to the tactical systems that enforce alignment and give everyone clean, reliable data.

Week 1: Audit and Diagnosis

Your first week isn't about changing anything. It’s about getting an honest, objective baseline. You have to quantify the problem before you can fix it. That means diving deep into your CRM to uncover the gap between what people think is happening and what the data actually shows.

Your goal is to answer these questions with hard numbers, not anecdotes:

- •What is our average lead response time? Pull a report on the time elapsed between lead creation and the first logged sales activity. Be prepared for a shock.

- •What’s our MQL-to-SQL conversion rate? This metric tells you how many leads marketing qualifies are actually accepted by sales as real opportunities.

- •What percentage of MQLs receive zero follow-up? Find the leads that fall through the cracks completely. This number represents pure, unadulterated revenue leakage.

These initial findings will be the uncomfortable truth that gets both teams to the table. When you can show that 35% of qualified leads are never touched, the conversation shifts from finger-pointing to a shared sense of urgency.

Week 2: Definition and Documentation

With the data in hand, Week 2 is all about getting the right people in a room to forge critical agreements. This is where you run structured workshops—not aimless meetings—with leaders from both sales and marketing.

Your main output is a Service Level Agreement (SLA). This isn't just corporate jargon; it's your constitution for lead management.

The SLA must explicitly define:

- •The Universal Lead Definition: What specific firmographic, demographic, and behavioral criteria must a lead meet to become an MQL? Get ruthlessly specific.

- •The Handoff Protocol: What is the exact process for passing a lead from marketing to sales? Which fields must be populated? Who gets the notification?

- •The Follow-Up Cadence: What is sales’ commitment? For example, "Every MQL will receive a minimum of 6 touches (3 calls, 3 emails) over 15 days."

Documenting these rules removes ambiguity and creates a written contract for mutual accountability. This is a non-negotiable step in building lasting revenue alignment.

Week 3: Implementation and Automation

Your agreements are useless if they just live in a Google Doc. Week 3 is where you translate those rules into automated workflows within your systems. This is where the RevOps mindset of using technology to enforce process really comes to life.

You’re not relying on human discipline alone; you’re building guardrails.

Key actions for this week include:

- •Building Lead Scoring: Translate your universal lead definition into a scoring model in your marketing automation platform.

- •Automating Lead Routing: Implement a round-robin or territory-based system that instantly assigns new MQLs to the right rep, killing manual assignment delays.

- •Creating SLA Alerts: Set up automated notifications that ping sales managers if a lead hasn't been touched within the agreed-upon timeframe (e.g., 2 hours).

By automating these processes, you're not just improving efficiency; you're building a system that scales. This is how Altior's philosophy of using AI and automation to amplify truth, not noise, works in practice.

Week 4: Measurement and Refinement

The final week of the sprint is about closing the loop. You started with a baseline, and now you go back to the data to prove the impact of your changes. This is how you build trust and secure buy-in for future initiatives.

You need to build simple, clear dashboards in your CRM that visualize the before-and-after picture.

Your "Smarketing" dashboard should track:

- •Lead Response Time: Did it drop from days to hours?

- •MQL-to-SQL Conversion Rate: Has this percentage started climbing?

- •Pipeline Velocity: Are deals moving through the funnel faster?

Success isn't a feeling; it's a number on a dashboard. By showing a 15% improvement in pipeline velocity within the first 30 days, you demonstrate tangible ROI. The data proves it: according to Freshworks, companies with tightly aligned teams enjoy 38% higher sales win rates. This is a clear incentive to maintain this new operational rhythm.

This sprint creates the foundation. The real work is maintaining this discipline month after month, using data as your guide to continuously refine the process.

The Tech Stack That Powers Real Alignment

Great strategy needs technology to scale, but let’s get one thing straight: a world-class tech stack can't fix a broken process. The right tools amplify clarity and enforce the rules you’ve already agreed upon, making alignment the path of least resistance.

So many companies make the classic mistake of buying expensive software before defining their underlying process. It’s a move that costs millions in wasted spend and shelfware. Your technology should be a reflection of your go-to-market strategy, not a substitute for it. The goal is to build an integrated ecosystem that creates a seamless flow of data from the first marketing touchpoint all a way to a closed-won deal and beyond.

The Core Components of an Aligned Stack

At the heart of any real sales and marketing alignment effort are three non-negotiable components. Think of them as the foundation for creating a single, unified view of the customer journey.

- •

A Single Source of Truth (CRM): This has to be your undisputed record for all customer data. Platforms like Salesforce or HubSpot are the usual suspects. Every interaction, every logged call, and every marketing email must flow back to the contact and deal record. This isn't just about data hygiene; it’s about creating a shared reality for both teams.

- •

Marketing Automation Platform (MAP): Tools like Marketo or Pardot are the engines for nurturing leads at scale. But here’s the critical part: they must be tightly integrated with your CRM. Behavioral data has to pass back and forth seamlessly to enable sophisticated lead scoring and timely handoffs.

- •

Sales Engagement Tools: Platforms like Salesloft or Outreach ensure sales teams actually execute the follow-up cadences defined in your SLA. They provide the structure for reps to follow up consistently and give leaders visibility into what’s actually being done.

The magic isn't in the individual tools, though. It’s in the integration layer that connects them. When data flows freely, marketing can see which campaigns produce real revenue, and sales gets the context they need to have smarter conversations. To get a more detailed look, our guide on building a Revenue Operations tech stack for B2B SaaS provides a comprehensive blueprint.

Using AI to Amplify Truth, Not Noise

Many companies see AI as a silver bullet, but its real power lies in amplifying an already solid operational foundation. It helps you find the signal in the noise by automating low-value tasks and surfacing high-impact insights. Used correctly, AI brings clarity, not more complexity.

Here’s how it works in practice:

- •

AI-Powered Lead Scoring: Instead of relying solely on manual rules that quickly become outdated, AI can analyze thousands of data points—from website behavior to past deal outcomes—to predict which leads are most likely to close. This helps prioritize sales' time on opportunities with the highest probability of success.

- •

Automated Data Entry: Let's be honest, one of the biggest drains on sales productivity is manual CRM updates. AI tools can automatically log calls, transcribe notes, and update deal stages. This frees up reps to spend more time selling and drastically improves data quality, giving marketing cleaner information for analysis.

As you build out your stack, exploring the role of AI sales assistants can be a game-changer for efficiency and alignment.

"AI doesn't create truth; it reveals it faster and at a greater scale. For RevOps leaders, the goal is to use automation not to replace human insight, but to remove the operational drag that obscures it." - Zorian Rotenberg, CEO of Atiim

This philosophy is central to a modern, aligned tech stack. Technology should serve the process by making it easier for your teams to do the right things. By integrating your core systems and thoughtfully applying AI, you build an operational engine that doesn’t just support alignment—it demands it.

Measuring the KPIs That Prove Alignment ROI

Laptop displaying financial charts, with a notebook, pen, and 'MEASURE ROI' text.

Here's the hard truth: alignment feels great, but feelings don't show up on a P&L statement. If you can’t draw a straight line from your alignment efforts to bottom-line results, you’re just having better meetings, not building a better business.

To prove the real impact, you have to ditch the vanity metrics like MQL volume. It's time to build the dashboard your CEO and board actually care about—one that replaces "I think this is working" with "the data proves this is working."

The Core Four Alignment Metrics

While you could track dozens of data points, my experience shows that four core KPIs tell 80% of the story. Get these right, and you'll know instantly if your alignment is creating real value.

- •Pipeline Velocity: This is the speedometer for your revenue engine. It measures how quickly deals move through your pipeline and how much value they represent each day. When this number goes up, it means your sales cycle is shrinking and revenue is becoming more predictable. Simple as that.

- •MQL-to-Close Conversion Rate: This is the ultimate alignment acid test. It tracks the entire journey from a marketing-qualified lead to a closed-won deal, immediately exposing any friction, leakage, or handoff failures along the way.

- •Sales Cycle Length: How long does it take from the first touch to a signed contract? A shrinking sales cycle is a direct byproduct of better qualification, cleaner handoffs, and more effective sales enablement—all hallmarks of true alignment.

- •Customer Acquisition Cost (CAC): This is the bottom-line efficiency metric. It calculates the total sales and marketing cost to acquire a single new customer. When alignment is humming, wasted spend plummets, and your CAC follows suit.

Tracking these numbers isn't just a reporting exercise; it's a critical part of a robust revenue enablement strategy. This is the feedback loop you need to continuously fine-tune your go-to-market motion.

Client Example: We helped a SaaS client, Company X, reduce their sales cycle from 90 to 45 days. A quick look at their MQL-to-Close rate showed a massive bottleneck right after the demo stage. Marketing was delivering qualified leads, but sales follow-up was inconsistent. By implementing a clear SLA and an automated follow-up sequence, Company X increased its trial-to-paid conversion rate from 12% to 18% in just 6 weeks.

The pressure to justify every dollar of spend with hard data is only increasing. In the APAC region, for instance, 79% of marketers are moving budgets to digital channels. With that shift, 62% now see media metrics as essential for getting a real-time pulse on performance, a huge jump from the 17% who still rely on gut feel. You can read more about aligning sales and marketing in APAC markets to see how intense this data-driven scrutiny has become.

RevOps Benchmarks for a €10M ARR SaaS Business

Knowing what to measure is half the battle. The other half is knowing what "good" actually looks like. Without benchmarks, your data exists in a vacuum. For scaling B2B SaaS companies, context is everything.

Here’s a cheat sheet for what you should be aiming for if you're in the ballpark of €10M ARR. Use it to see how you stack up.

| Metric | Below Average | Industry Standard | Top Performers |

|---|---|---|---|

| Pipeline Velocity | < €2,000 / day | €3,500 - €5,000 / day | > €7,000 / day |

| MQL-to-Close Rate | < 0.5% | 0.75% - 1.25% | > 1.5% |

| Sales Cycle Length | > 120 Days | 75 - 90 Days | < 60 Days |

| CAC Payback Period | > 18 Months | 10 - 14 Months | < 8 Months |

Think of these numbers as diagnostic tools. If your MQL-to-Close rate is 0.4%, you don't have a "sales problem" or a "marketing problem"—you have an alignment problem. This data-driven approach lets you stop the blame game, pinpoint the exact friction point in your funnel, and fix it with surgical precision.

Common Sales and Marketing Alignment Questions

Even with the best playbook in hand, theory and reality can be two different things. Getting sales and marketing alignment right means hitting some predictable roadblocks. Let's tackle the most common questions we hear from founders and RevOps leaders who are trying to make this work in the real world. No fluff, just practical answers.

What Is the First and Most Important Step to Improve Alignment?

Forget everything else until you have a shared, data-driven definition of a qualified lead (MQL/SQL). This is the single most critical first step. Period.

This isn't an email chain; it's a mandatory workshop where both teams agree on the exact firmographic, demographic, and behavioral signals that make a lead worth pursuing. Without this universal definition, you're building on sand. The "lead quality" debate will never end, and every other initiative will stall.

Once you agree, document it in your SLA and hard-code it directly into your marketing automation and CRM. This removes subjectivity and forces the system to be the single source of truth.

How Often Should Sales and Marketing Teams Meet?

A weekly "Smarketing" meeting is the ideal cadence. This isn't another high-level strategy session—it's a tactical, in-the-weeds check-in designed to solve problems on the fly.

Keep the agenda ruthlessly data-driven. You should be looking at the entire funnel, from MQL to close, every single week. Key discussion points have to include:

- •MQL volume and, more importantly, quality trends.

- •Conversion rates at each stage (MQL > SQL > Opportunity).

- •Pipeline velocity. Are deals getting stuck anywhere?

- •A live review of leads disqualified by sales to see what’s really happening.

Our Sales Team Says Marketing Leads Are Low Quality. How Do We Fix This?

This is the classic, textbook sign of misalignment. The only way to solve this is to replace opinions with a system built on data. It’s a three-part fix.

First, implement lead scoring that weighs both explicit data (like job title and company size) and implicit behavior (like visiting the pricing page or requesting a demo). Second, get that non-negotiable Service Level Agreement (SLA) in place, defining not just what a qualified lead is, but also the exact follow-up protocol sales must adhere to.

But the third step is the real game-changer: a mandatory, closed-loop feedback mechanism. When a sales rep disqualifies a lead in the CRM, they must select a specific, predefined reason. This data is absolute gold for marketing. It allows them to spot trends and systematically fine-tune campaigns, messaging, and targeting.

What Is a Realistic Timeline to See Results?

You need to aim for quick wins within 30-60 days. These early results are crucial for building trust and showing both teams that this new way of working is actually making a difference.

For example, you can see improvements in lead response time within two weeks of rolling out automated routing and SLAs. You should see a measurable lift in your MQL-to-SQL conversion rate within the first month.

Bigger business outcomes, like a 15–25% improvement in pipeline velocity or a noticeable drop in your sales cycle length, usually start showing up around the 90-day mark as the new processes become second nature.

Ready to stop debating and start executing? The frameworks in this guide are the foundation of our work at Altior & Co. We apply them systematically to help B2B SaaS companies uncover and fix the revenue leaks hiding in their go-to-market process. Expect a 15–25% improvement in pipeline velocity within 6 weeks.

Learn how the 6-Week Revenue Growth Sprint applies this framework to your business.