Build a repeatable go-to-market strategy for B2B SaaS. This guide covers defining your ICP, aligning teams, and driving measurable revenue growth.

A solid go-to-market strategy should be the blueprint for a repeatable revenue engine. But for too many B2B SaaS companies, it’s a messy collection of siloed sales and marketing tactics. The result? Leaky funnels, misaligned teams, and a whole lot of wasted budget.

This isn't just about launching a product. It's about systematically engineering growth. If your revenue feels unpredictable, this guide provides a step-by-step framework to diagnose the leaks, align your teams, and build a GTM engine that actually works.

Why Your Go-To-Market Strategy Is Leaking Revenue

Let's be direct. If your sales reps are complaining about lead quality while marketing is questioning why conversion rates are tanking, your go-to-market strategy is broken. These aren't just departmental squabbles; they're symptoms of a fractured system where perception and reality don't match up.

I’ve seen it dozens of times: sales leaders report 80% follow-up compliance in meetings, but a quick look at CRM data shows it's closer to 25%. It’s in that disconnect—the gap between what you think is happening and what’s actually happening—that revenue silently slips through the cracks.

Two professionals discussing go-to-market strategy presentation about fixing GTM leaks with funnel visualization

The problem isn't a lack of effort. It’s the absence of a unified, data-backed plan that connects every single action to a measurable business outcome. Without one, you’re just guessing.

Diagnosing the Core Issues

A failing GTM strategy almost always shows up in a few predictable ways. Spotting these signs early is the first real step toward building a system that actually works.

Here are the most common pain points you might be feeling:

- •Misaligned Teams: Sales, Marketing, and Customer Success are all operating in their own worlds. They have conflicting KPIs and can't even agree on what a "good" customer looks like.

- •Inconsistent Messaging: A prospect sees one thing in an ad, hears another on a sales call, and gets a completely different message during onboarding. This creates confusion and kills deals.

- •Wasted Spend: Marketing burns cash on campaigns that generate leads the sales team can't—or won't—work. According to Forrester, this misalignment can cost B2B companies 10% or more in annual revenue.

- •Long Sales Cycles: Deals just sit there, stalled in the pipeline, because there’s no clear process for moving prospects from one stage to the next.

"Most GTM strategies fail not because of a bad idea, but because of broken execution. The gap between what leadership thinks is happening and what the data shows is where millions in ARR are lost." - RevOps Leader

The good news? These leaks are fixable. But it requires a shift in mindset: you have to stop treating symptoms and start diagnosing the root cause. And that begins with an honest look at your data.

Before you dismiss this as "soft stuff," let's look at the numbers. Research from Harvard Business Review shows that companies planning their market entry in detail hit a 65% success rate. And 76% of businesses that use detailed customer insights report better product-market fit—a non-negotiable for growth. You can explore more on these go-to-market statistics to see just how critical this is.

To pinpoint where things are going wrong, it helps to map common symptoms to their likely causes. This is the first diagnostic step we take in any GTM engagement.

Common GTM Failure Points and Their Symptoms

| Symptom | Potential Root Cause | Key Metric to Investigate |

|---|---|---|

| High MQL volume, low SQL conversion | Vague ICP definition; misaligned MQL criteria between Sales & Marketing | MQL-to-SQL Conversion Rate; Lead Source Performance |

| Sales reps complain about lead quality | Ineffective lead scoring; content attracting wrong audience | Lead-to-Opportunity Conversion Rate; Time-to-Disqualify |

| Long sales cycles with high drop-off | Unclear buyer journey; friction in the handoff process | Sales Cycle Length by Stage; Pipeline Velocity |

| High customer churn within first 90 days | Misaligned value propositions sold vs. delivered; poor onboarding | First 90-Day Churn Rate; Customer Satisfaction (CSAT) Scores |

| Low marketing ROI and high CAC | Targeting too broad an audience; ineffective channel mix | Customer Acquisition Cost (CAC); Channel-Specific ROI |

Looking at this table should give you a starting point. By connecting a clear business pain (the symptom) to a potential system failure, you can start asking the right questions.

This guide will give you a practical framework to repair your strategy, turning it from a source of constant friction into an engine for predictable growth. If you suspect your funnel is leaking, you can start by identifying the financial hit with our free revenue leak calculator.

Now, let's get into how we diagnose, fix, and measure.

Define Your Ideal Customer Profile with Precision

Your go-to-market strategy lives or dies by how well you know your customer. Yet, I see it all the time: B2B SaaS companies are still running on vague, outdated personas like "Startup Steve" or "Enterprise Erica."

These personas feel productive, but they're often just a collection of assumptions. They lead your sales and marketing teams to chase deals that will never, ever close.

A weak Ideal Customer Profile (ICP) is the single biggest source of revenue leaks in a SaaS business. It's why marketing generates leads that sales instantly rejects, and it's why sales cycles drag on for months only to end in ghosting. Getting beyond these generic descriptions is the first real step to building a GTM engine that actually works.

Business professional analyzing ideal customer data with charts and graphs on laptop screen

The goal here isn't just to describe who could buy your product. It’s about pinpointing the exact attributes of the companies that get the most value from it—and in turn, deliver the highest lifetime value (LTV). It’s about focusing your resources with surgical precision.

Moving from Assumptions to Data Verification

To build an ICP that has teeth, you have to stop guessing and start digging into your own systems. Your CRM is a goldmine of truth, holding the patterns that define your best customers. It's time to analyze not just who you sold to, but who stuck around, expanded their account, and became your biggest advocates.

This process means looking at three core data categories:

- •Firmographics: This is the basic stuff, but you need to go deeper. Move beyond just industry and employee count. Look at annual revenue, growth stage (e.g., Seed, Series A/B), and geographical footprint. Are your best customers consistently in the €5M-€15M ARR range? That’s a real signal.

- •Technographics: What does their current tech stack look like? This is a huge tell. Pinpointing complementary or competing technologies can be a powerful qualifier. For instance, knowing a prospect uses HubSpot and Salesforce often points to a certain level of operational maturity.

- •Behavioral Data: How do they actually engage with you? Look at product usage metrics, support ticket frequency, and content consumption. You might find that customers with the highest LTV all adopt a key feature within the first 30 days.

This data-driven approach almost always uncovers a reality that’s surprisingly different from what your team thinks is true. A Gartner report found that companies with strong GTM strategies are 60% more likely to hit their revenue goals within a year of launch—and a precise ICP is the bedrock of that strength.

A world-class ICP is a filter, not a net. It tells your team who not to spend time on, which is often more valuable than knowing who to target. It's the ultimate tool for resource allocation.

An ICP in Action

Let’s make this concrete. I worked with a SaaS client whose ICP was, I kid you not, "all tech companies." As you can imagine, their sales team was completely spread thin, and their customer acquisition cost (CAC) was through the roof.

By digging into their CRM data, we found a stark pattern. Their most successful customers—the ones with high retention and expansion revenue—weren't just "tech companies." They were specifically:

- •Series B FinTechs

- •Located in the UK or Germany

- •With 50-200 employees

- •Using Stripe as their payment processor

Armed with this newfound clarity, they completely refocused their GTM efforts. Marketing stopped bidding on broad tech keywords and instead created content addressing the unique compliance challenges of European FinTechs. The outbound sales team built hyper-targeted lists based on funding rounds and technographic data.

The result? Company X increased their trial-to-paid conversion from 12% to 18% in 6 weeks and cut their customer acquisition cost by 40%. That's the power of moving from a vague persona to a precise, data-verified ICP. It allows you to craft a value proposition that lands perfectly because it speaks directly to a well-defined set of problems.

Map the Modern B2B Buyer Journey

Now that you've locked in your Ideal Customer Profile, it's time to map how they actually buy. Let's be honest: the old-school marketing funnel—that neat, linear path from awareness to purchase—is a fantasy in today's B2B world. It just doesn't exist anymore.

Your buyers are in complete control. They're consuming content across a dozen channels, getting peer recommendations on Slack, and only engaging with your sales team after they've done most of their homework. This shift means your go-to-market strategy can't survive on a simple handoff from marketing to sales. You need a map of the entire, often messy, multi-touchpoint journey your customers take.

Business team collaborating on buyer journey map with colorful sticky notes on whiteboard

This isn't just a whiteboard exercise. It’s about getting inside your ICP's head to understand the specific questions they ask at each stage, the content that gives them the answers they need, and which team—Marketing, Sales, or CS—should be the one delivering it.

Beyond the Linear Funnel

The modern B2B buyer completes a huge chunk of their research on their own before ever wanting to talk to a salesperson. They're digging through G2 reviews, watching your competitor's demos, and asking their network for advice.

This self-education phase is where siloed teams completely fall apart.

Without a shared map of the journey, Marketing ends up creating top-of-funnel content that doesn't address the real questions sales-qualified prospects have. Then, Sales jumps in with messaging that feels totally disconnected from the prospect's initial research. That friction kills deals. Real alignment—what we're aiming for here—means every touchpoint feels like a natural continuation of the last, no matter which department is leading the conversation. For a deeper dive, check out our guide on what sales and marketing alignment truly means.

A unified CRM like HubSpot or Salesforce is the only way to make this work. It has to be your single source of truth, tracking every interaction and giving you the complete picture of the journey, not just isolated snapshots from different teams.

The 3-Question Framework to Find the Bottlenecks

Mapping the journey is one thing; plugging the leaks is where the money is. When deals stall out, it’s almost never for a random reason. There's a specific point of friction you have to find and fix. Instead of another generic pipeline review, use this simple three-question framework to diagnose exactly where and why your prospects are getting stuck.

For any deal that's been sitting in a pipeline stage longer than your average, ask these three things:

- •What question does the buyer need answered to move forward? Is it about pricing? Security? A specific integration?

- •Who is the best person in our company to answer it? The AE might not be the right person. Maybe it's a solutions engineer, a product manager, or even a customer success lead.

- •What content or resource would answer this most effectively? Do they need a case study, a technical doc, a security whitepaper, or just a quick two-minute video tutorial?

This framework forces your team to stop thinking about internal sales stages and start seeing the world from the buyer's perspective. The whole focus shifts from "pushing the deal forward" to "removing the obstacle."

By consistently asking these three questions, you transform your sales process from a rigid sequence into a responsive, buyer-centric conversation. It’s how you uncover the real friction in your GTM motion and begin to systematically eliminate it.

Defining Ownership at Every Stage

A clear journey map does one more critical thing: it assigns ownership. It makes it crystal clear which team is responsible for which interaction, ensuring a seamless experience for the buyer. This isn't about creating rigid rules; it's about building clear accountability.

Here’s a simple way to think about it:

- •

Awareness & Education (Marketing-Led):

- •Buyer's Goal: Understand their problem and see what solutions are out there.

- •Your Goal: Provide genuinely helpful, non-gated content (blogs, reports, webinars) that shows you know what you're talking about.

- •Ownership: Marketing creates and distributes the content.

- •

Consideration & Evaluation (Sales & Marketing Collaboration):

- •Buyer's Goal: Compare vendors and create a shortlist. They need detailed product info and proof that you deliver.

- •Your Goal: Serve up targeted content (case studies, competitor comparisons, deep-dive demos) that highlights why you're the best choice.

- •Ownership: Marketing builds the assets; Sales uses them in targeted conversations and discovery calls.

- •

Decision & Purchase (Sales-Led):

- •Buyer's Goal: Justify the purchase internally and get through procurement. They need ROI calculators, security docs, and implementation plans.

- •Your Goal: Make it ridiculously easy to buy from you. Offer clear pricing, simple contracts, and access to technical experts.

- •Ownership: Sales runs the commercial conversation, pulling in legal and solutions engineering as needed.

Mapping this journey isn't a one-and-done project. It’s a living process of listening to your customers, digging into your CRM data, and constantly refining your approach to remove friction wherever you find it.

Activate Your Strategy with High-Impact GTM Plays

A brilliant go-to-market strategy is worthless if it just gathers dust in a presentation deck. Real growth happens when you translate that plan into specific, measurable actions. This is where you stop theorizing and start executing with high-impact GTM plays.

Think of a GTM play as a mini-campaign with a single, clear objective. It’s not about boiling the ocean; it's about making focused bets. This could be anything from an outbound sequence targeting your newly defined ICP in a specific vertical to a co-marketing webinar with a strategic partner, or even a re-engagement campaign for all those closed-lost opportunities from the last six months.

The goal here is to generate momentum. By running small, targeted plays, you create quick wins that build confidence across the team, generate early data, and prove the new strategy is actually working.

Prioritizing Your First Moves

You can't do everything at once, and trying is the fastest way to fail. The key to successful execution is ruthless prioritization. Instead of guessing, use a simple framework to score potential GTM plays and decide where to put your resources first.

Evaluate each potential play against three core criteria:

- •Potential Impact: How much revenue or pipeline could this play realistically generate? Is it a small win or a potential game-changer?

- •Required Effort: How many resources—time, budget, people—will this take to launch? Is this a one-week sprint or a multi-month project?

- •Strategic Fit: How well does this play align with our core GTM objectives and new ICP definition? Is it a distraction or a direct path to our goals?

When you map your ideas on an impact vs. effort matrix, the quick wins become painfully obvious. These high-impact, low-effort plays should always be your first move. They build the momentum you need to tackle larger, more complex initiatives down the line.

Your first GTM play isn't about hitting a home run; it's about getting on base. Focus on a quick win that validates your ICP and messaging, delivering a tangible result within 30 days. This proves the system works and builds trust between teams.

The 30-Day Sales and Marketing Alignment Sprint

One of the highest-impact plays you can run right out of the gate is a sprint focused on tightening the bond between sales and marketing. This is where most GTM strategies fall apart—in the messy handoff. This tactical 30-day plan forces collaboration and creates a shared system for lead management.

Here’s a week-by-week breakdown:

Week 1: Redefine the Handoff

- •Goal: Get everyone to agree on what a good lead actually is.

- •Actions: Sales and Marketing leaders meet to co-create and sign off on updated definitions for MQLs and SQLs. The criteria must be so clear that there's zero ambiguity.

- •Success Metric: A signed Service Level Agreement (SLA) document defining handoff criteria and a maximum lead response time of under 4 hours.

Week 2: Implement Lead Scoring

- •Goal: Automate lead prioritization so sales works the best leads first.

- •Actions: Your RevOps lead or CRM admin builds a lead scoring model based on the firmographic, technographic, and behavioral data points you all agreed on in Week 1.

- •Success Metric: The lead scoring model is live in your CRM, and 100% of new inbound leads are being scored automatically.

Week 3: Launch a Joint Content Campaign

- •Goal: Activate the new ICP focus with a targeted campaign everyone is bought into.

- •Actions: Marketing launches a content piece (like a webinar or an in-depth whitepaper) aimed directly at the ICP's core pain points. The sales team commits to following up with every single MQL generated from it.

- •Success Metric: Generate 50+ MQLs that meet the new criteria and achieve 95% sales follow-up within the agreed SLA.

Week 4: Review, Refine, and Repeat

- •Goal: Analyze the data to see what worked and what didn't, then optimize.

- •Actions: Both teams get in a room to review the sprint's performance. What worked? What broke? Use the data to refine the lead scoring model and plan the next joint play.

- •Success Metric: A clear report showing the MQL-to-SQL conversion rate for the campaign and a prioritized list of actions for the next 30-day sprint.

This sprint turns the abstract idea of "alignment" into a concrete set of actions with clear owners and deadlines. It’s a powerful first step in making your GTM strategy something you do, not just something you have. This is where the rubber meets the road. And in fast-growing markets, it's non-negotiable. For instance, with the digital advertising market in the Middle East and North Africa set to hit $12.3 billion in 2024, having a tightly aligned execution plan is the only way to capture market share. Learn more about MENA's expanding GTM landscape.

Measure What Matters for Predictable Revenue

If you can't measure it, you can't manage it. And you certainly can’t scale it. A solid go-to-market strategy runs on data, not gut feelings. Yet most companies are drowning in a sea of vanity metrics—social media likes, website traffic—that feel good but tell you absolutely nothing about the health of your revenue engine.

To build predictable revenue, you have to cut through the noise. It's about focusing on the handful of Key Performance Indicators (KPIs) that are directly tied to ARR growth. This isn't about building more dashboards; it's about creating clarity. It’s about building a system that reveals the unfiltered truth about what's working and what's not, closing the dangerous gap between what your team thinks is happening and what the data proves.

Moving Beyond Vanity Metrics

Your CRM should be the single source of truth for your entire GTM motion. Period. When it’s set up correctly, it lets you track the metrics that actually signal business health. I’ve seen it time and again: leaders believe their teams are hitting it out of the park, but the data often tells a completely different, and sometimes alarming, story.

For a €4M+ ARR SaaS company, there are three core metrics that are completely non-negotiable for understanding your GTM effectiveness.

- •Pipeline Velocity: This is the pulse of your sales engine. It measures how quickly deals are moving through your pipeline and how much value they represent, telling you the real speed of your revenue engine.

- •Customer Acquisition Cost (CAC) Payback Period: This is the raw truth about your growth efficiency. It’s the time it takes to recoup the cost of acquiring a new customer. A shorter payback period means a healthier, more sustainable growth model.

- •Net Revenue Retention (NRR): This metric reveals the stickiness of your product and the health of your customer base. It shows you how much your revenue grows (or shrinks) from existing customers. Anything over 100% means your business is growing even without adding a single new logo.

“What you measure, you improve. Most GTM strategies fail because they track activity, not impact. Focusing on Pipeline Velocity, CAC Payback, and NRR forces a conversation about efficiency and value, which is the core of sustainable growth.” — Jason Lemkin, Founder of SaaStr.

These aren't just numbers on a spreadsheet; they are powerful diagnostic tools. A slow pipeline velocity points to friction in your sales process. A long CAC payback period signals a problem with your pricing or ICP. And a low NRR indicates a painful disconnect between the value you promised and the value you actually delivered.

What Good Looks Like GTM KPIs for SaaS

Knowing the formulas is one thing, but knowing what "good" looks like is another. Here’s a baseline for what a healthy, scaling SaaS business should be aiming for.

| GTM Metric | How to Calculate It | "Good" Benchmark for €4M+ ARR SaaS |

|---|---|---|

| Pipeline Velocity | (Number of Opps x Avg. Deal Size x Win Rate) / Sales Cycle Length in Days | €10,000+ per day (highly dependent on ACV) |

| CAC Payback Period | (Sales & Marketing Costs) / (New MRR x Gross Margin) | < 12 months |

| Net Revenue Retention | (Starting MRR + Expansion - Churn) / Starting MRR | 110% or higher |

If your numbers are way off these benchmarks, it’s a flashing red light. It's a clear signal that a core component of your go-to-market strategy—be it your ICP, your buyer journey map, or your GTM plays—is broken. It gives you a specific, undeniable area to investigate and fix.

The RevOps Tech Stack for Accurate Tracking

You can’t track these metrics with spreadsheets and guesswork. It just doesn't work. Accurate measurement requires a clean, integrated tech stack where your CRM is the undisputed source of truth.

The essential stack includes:

- •CRM (e.g., HubSpot, Salesforce): This is the foundation. It must be meticulously maintained to ensure all customer interaction data is captured accurately. No exceptions.

- •Marketing Automation (e.g., Marketo, HubSpot): For tracking lead sources, campaign attribution, and engagement across the top of the funnel.

- •Revenue Intelligence Tools: Platforms like these provide deeper insights into pipeline health and sales activity, helping you understand the why behind the numbers. You can explore our guide on how revenue intelligence transforms GTM performance.

This interconnected system is where AI and automation can really amplify the truth. For example, automated lead routing ensures SLAs are met, while AI-powered analytics can spot pipeline risks long before a human can. This operational rigor is crucial, especially when adapting to market shifts.

Recent data from South Africa shows just how fast channels can change; while direct selling saw a 13.2% decline in 2023, e-commerce surged by 29%. This underscores the absolute need for a measurement system that can detect and react to shifts in buyer behavior in real-time. Discover more insights about these market trends. Without a solid data foundation, you’re just flying blind.

Your 6-Week GTM Optimization Sprint

All the frameworks in the world won't help if they just sit in a slide deck. A plan without a timeline is just a wish. This is where we get our hands dirty and turn theory into an execution plan that actually drives revenue.

A structured sprint is what transforms your go-to-market strategy from a static document into a living, breathing process that gets results.

We run a 6-Week Revenue Growth Sprint that puts every concept from this guide into practice. It’s designed to build momentum fast and deliver tangible wins you can see in your pipeline.

The Sprint Breakdown

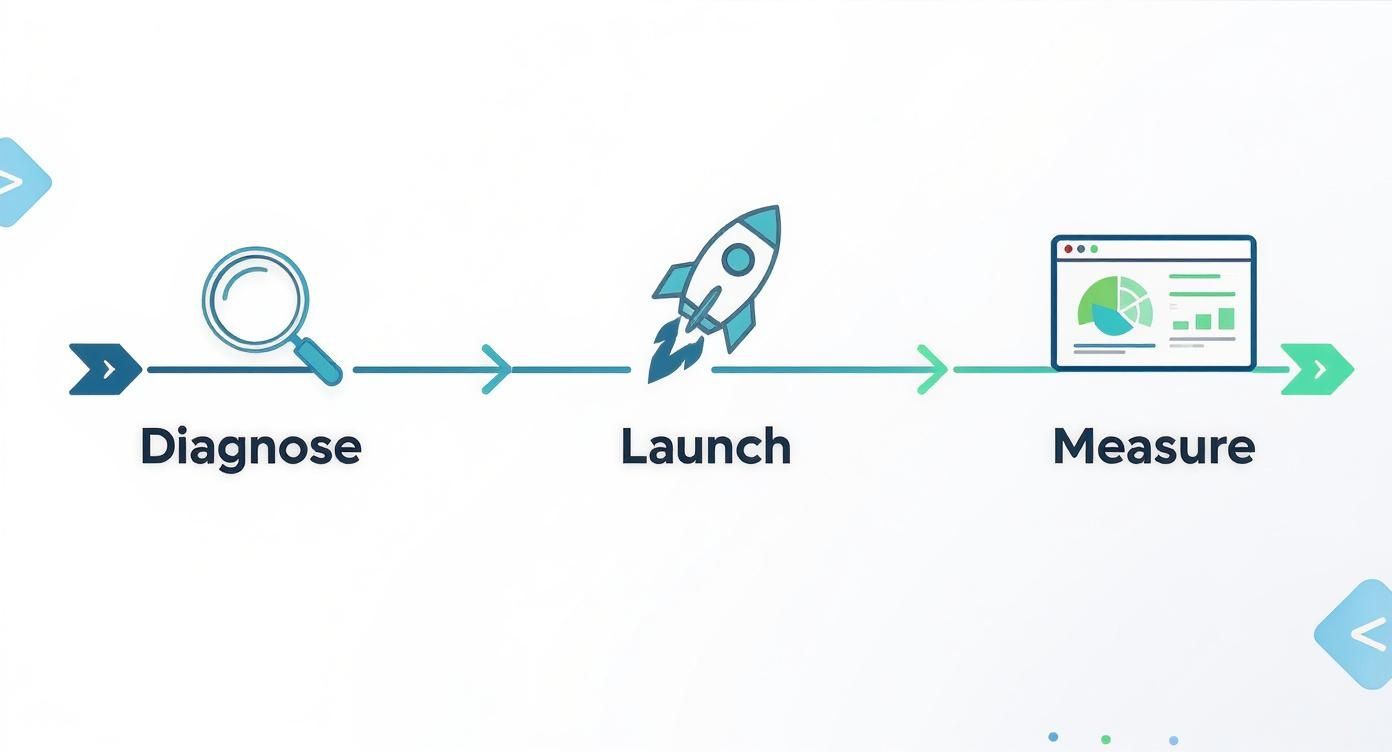

The entire process is broken down into three distinct, two-week phases.

- •Weeks 1–2: Diagnose & Define. This is where we get brutally honest about what's working and what's not. We dive straight into your CRM data to find the real funnel leaks and use that intelligence to hammer out a razor-sharp ICP. No more guesswork.

- •Weeks 3–4: Map & Launch. Once we know exactly who we're targeting, we map their real-world buyer journey—not the one we wish they had. From there, we launch your first high-impact GTM play, a focused pilot designed for a quick, measurable win.

- •Weeks 5–6: Measure & Scale. Finally, we lock in the core KPIs that actually matter to ARR and build the RevOps dashboard to track them. This gives you the visibility you need to stop guessing and start scaling what works.

This isn't just about moving fast; it's about moving smart.

Three stage go-to-market strategy process showing diagnose, launch, and measure phases with icons

Each phase builds directly on the last, making sure your strategy is grounded in hard data before you pour resources into scaling it. It's a clear, repeatable path to turning your GTM efforts into a genuine growth engine.

Following this exact sprint, our clients typically see a 15–25% improvement in pipeline velocity within a single quarter.

Your Go-To-Market Strategy Questions, Answered

Let's cut through the noise. Here are the straight answers to the questions B2B SaaS leaders are asking about building and fixing their go-to-market strategy. No theory, just practical advice from the field.

How Often Should We Actually Review Our Go-To-Market Strategy?

Your GTM strategy isn't a static document you frame on the wall; it’s a living blueprint for growth. For early-stage SaaS companies, a quarterly review is non-negotiable. You’re constantly getting market feedback and iterating on the product, so your strategy has to keep pace.

Once you cross the €10M+ ARR mark, you can shift to a deep-dive review every six months, but this should be backed by rigorous monthly KPI check-ins. Don't just wait for the calendar, though. The market gives you signals. If you miss revenue targets for two straight quarters, a major competitor makes a move, or you're launching a new product, that's your trigger for an immediate, full-scale review.

What's the Single Biggest Mistake Companies Make with Their GTM Strategy?

Easy. Failing to get genuine, ironclad alignment between Sales, Marketing, and Customer Success. This isn't a "soft skills" problem; it's a revenue-killer.

You see it everywhere: fights over lead quality, wildly inconsistent messaging from one team to the next, and a clunky, painful customer handoff that sours the relationship before it even starts. When each department is chasing its own metrics instead of a shared, data-backed understanding of the ICP and buyer journey, you’re not growing—you’re sabotaging your own ARR. According to Highspot, roughly 85% of enterprises say effective GTM strategies drive their core objectives, and that effectiveness starts and ends with alignment.

The root of most GTM failures is internal friction. When Sales and Marketing can't agree on a single definition of a 'good lead,' you don't have a strategy—you have a civil war over budget.

Can We Build a GTM Strategy Without a Dedicated RevOps Team?

Yes, you can absolutely start without a formal RevOps team, but you absolutely cannot succeed without a RevOps mindset. In smaller companies, the CEO or CRO often has to own the GTM process by default. The critical part is designating a single owner for your "revenue infrastructure"—the CRM data, the process docs, and the core metrics.

As you scale, this role naturally becomes a dedicated RevOps function. But the core principles—data-driven alignment and a single source of truth—must be there from day one. Without that clear ownership, chaos wins. Your data becomes unreliable, and every strategic decision you make is just a shot in the dark.

Your go-to-market strategy is the blueprint for predictable growth, but only if it's built on a foundation of truth. At Altior & Co., we use data to expose the gap between perception and reality, giving you a clear roadmap to fix revenue leaks and align your teams. Expect a 15–25% improvement in pipeline velocity within 6 weeks.

Learn how the 6-Week Revenue Growth Sprint applies this framework to your business. Get in touch with Altior & Co.